Market analysts predict that a huge wave of ethylene expansion in China is about to erupt. However, due to trade frictions between China and the United States, the supply of ethane in the United States, which is an important raw material for ethylene production, is limited, which weakens the competitiveness of ethane to ethylene in China and brings variables to the Chinese ethylene market.

Because olefins in China are profitable and ethane in the United States is cheap, IHS Markit estimates that 10 companies are currently building or studying cracking projects based on imported ethane from the United States. The total ethylene production capacity of these units is 16.1 million tons per year, and ethane consumption will reach 20.5 million tons per year.

Among these 10 companies, the most advanced one is a 650,000 tons/year cracking unit being built by Singapore Sinpu Chemical Company in Taixing, Jiangsu Province, which is expected to be put into operation in 2020. The unit will consume about 270,000 tons of ethane per year in the United States. The company has signed many years of ethane supply agreements with Ineos. The first supply of ethane from the United States is about to be delivered. This is also the first time that the United States exports ethane to China. Another pyrolysis facility under construction, which uses American ethane as raw material, is a pyrolysis facility of Satellite Petrochemical in Lianyungang, Jiangsu Province. Satellite Petrochemical plans to build two new ethane cracking units in Lianyungang, each with a capacity of 1.25 million tons per year. Ethane feedstocks will be provided by a joint venture between Satellite Petrochemical and Energy Transfer Partners.

However, IHS Markit believes that the future supply of ethane in the United States is uncertain, especially when the construction boom of the second wave ethane cracking plant in the United States is on schedule. This will put pressure on the supply of ethane, and will also raise the cost of raw materials for Chinese importers.

IHS Markit said that the growing trade disputes between China and the United States have also brought uncertainty to the prospects of China's ethane cracking projects. Although ethane has not yet been included in China's tariff list, the competitiveness of China's ethane cracking projects will be significantly reduced if tariffs are imposed. IHS Markit said: & ldquo; Tariff increases will leave many ethane cracking projects in China facing uncertainty. ”

As part of the countermeasure, China imposed a 25% tariff on propane from the United States last year. If the U.S. -China trade dispute escalates again, companies such as Xinpu Chemical may choose propane from outside the United States as cracking material. This will increase the cost of olefins in China to some extent. IHS Markit predicts that if tariffs are imposed, China's ethane cracking units will be less competitive than naphtha cracking units.

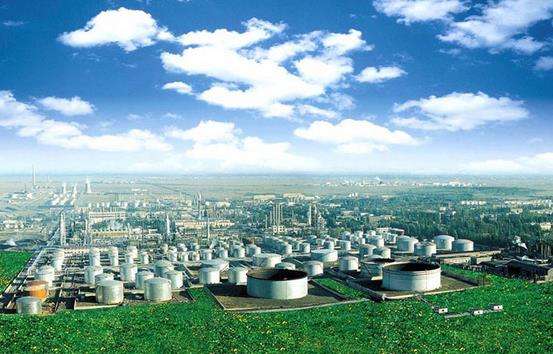

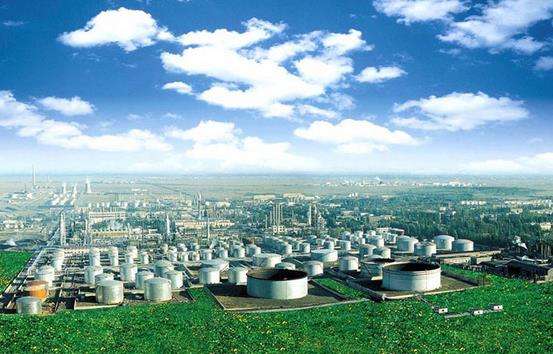

For a long time, China's olefin product supply can not meet the domestic market demand. At present, China has become the second largest ethylene producer in the world after the United States. In 2018, China's total ethylene production capacity was about 26 million tons, accounting for about 14% of the world's total production capacity, but still could not meet the current 42 million tons of ethylene consumption.

In such a market environment, China's ethylene production profits are very strong. This has stimulated investment in ethylene production and led to the construction of a large number of new ethylene plants. IHS Markit estimates that China will increase its ethylene cracking capacity by more than 27 million tons per year from 2020 to 2027, while another 6 million tons per year of coal-based olefins and methanol-based olefins will be put into operation.