[introduction] in the past few years, the world witnessed by the Asia Pacific and the Middle East as lead to a surge in new petrochemical production capacity, the two areas now continue to build petrochemical production capacity, to meet the demand, and increase its downstream products business. Another strong competitor is the United States, which has announced an investment of more than $13 million in the construction of a petrochemical project. The United States plans to add millions of tons of new petrochemical capacity each year, which is based on the cheap, easy to get shale gas raw materials.

By the end of 2020 the global petrochemical industry will continue to grow strongly, and many new construction projects are still under construction. The most important expansion will be in developing countries in the Asia Pacific and the Middle East, which will invest heavily in petrochemical production to provide a growing demand and diversify the product. While some of the most robust growth is considered in the United States, where cheap natural gas fueled a new petrochemical production capacity of more than 135 billion U.S. dollars of investment.

At the same time, drop of oil and gas spread to some regions such as Western Europe and Northeast Asia, naphtha cracker with oil based even more feasible than in previous years. In some areas such as the United States and the Middle East operation compared with ethane PYROLYSIS NAPHTHA still maintain a price advantage, but the gap has narrowed considerably. This provides a new life for naphtha cracking operation, because the cost of raw materials in the past 2 years has fallen sharply.

Construction project statistics

As of April 2016, “ hydrocarbon processing ” Journal of statistical building database tracking the global over 2000 downstream projects. This is likely to invest nearly $1 trillion and 600 billion by 2030. In the downstream processing project, the petrochemical sector accounted for about 35% of the global total construction project, which has just over 700 projects in the world. The oil refining projects accounted for 36%, gas processing /LNG projects accounted for 22%, other 7%.

In the petrochemical construction industry, the Asia Pacific region continued to maintain the maximum amount of construction projects in the total. In the general petrochemical construction projects, the Asia Pacific region accounted for 31%, the Middle East accounted for 22%, the United States accounted for 16%, Europe accounted for 14%, Latin America accounted for 11%, 4% of Africa, Canada accounted for 2%. These projects by the China and India petrochemical production capacity increased to lead. The Middle East is still the second highest number of construction projects, there are nearly 160 projects. The region has invested heavily in the establishment of its downstream products business. This includes the billions of dollars of investment in the construction of mixed feed cracking unit, as well as the ability of ethylene derivatives. Saudi Arabia, Kuwait and Oman will increase the capacity of millions of tons of additional Petrochemical capacity by the end of 2020. With the west to ease sanctions, Iran has ambitious plans to build its own petrochemical infrastructure.

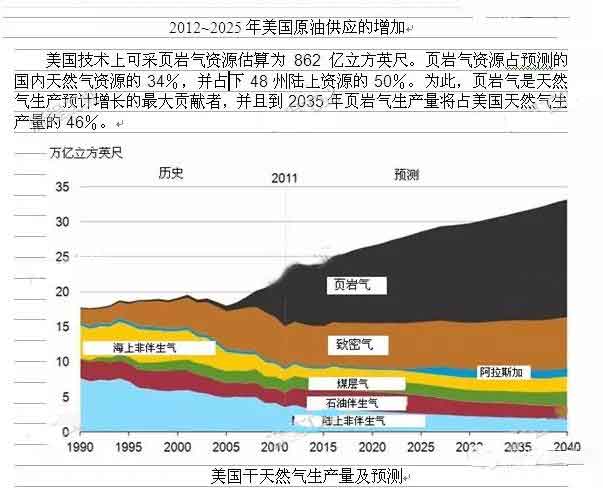

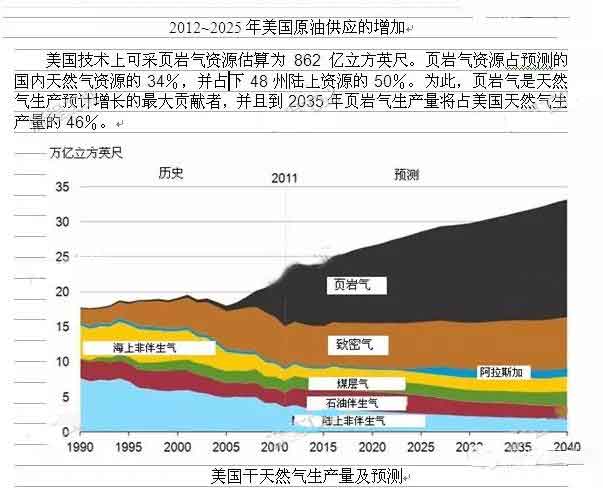

The United States accounted for 16% of the market share of the construction of the petrochemical project, the United States in the past few years, the new project has been a huge increase. With the advent of the shale oil and shale gas boom, the rich cheap natural gas to drive new investment in the United States petrochemical. These investments include the ability to ethylene plant and ethylene derivatives, as well as the ability to increase the capacity of millions of tons / year of methanol, the synthesis of ammonia urea and propane dehydrogenation (PDH). These launched the construction of the petrochemical project has nearly 60% in the pre construction phase.

Most of the petrochemical projects in the pre construction phase are in the Asia Pacific and the middle east. These two regions accounted for about 56% of the petrochemical project in the pre construction stage. The United States and Europe (including Eastern Europe, Russia and the CIS), behind the Asia Pacific and the Middle East, each accounted for 15% of the market share.

Asia Pacific and the Middle East also accounted for the majority of the current petrochemical projects under construction. Asia Pacific and the Middle East in the construction projects accounted for the total market share of 33% and 23%.

1, the construction of new projects

It has been announced that the total new downstream projects have declined over the past few years. As already announced the new petrochemical project since 2014 has decreased in the past three years, has announced the new petrochemical project in 2014 from nearly 170 in 2015 fell to 130, and in 2016 to just over 100, which shows in the world over the past three years already announced a new stone project down 38%.

Although the new petrochemical projects have been announced, but in the past three years the world has witnessed the already announced 400 new petrochemical projects, a total investment of more than 180 billion u..

2, delay, delay and cancellation of the project

The fall in oil prices has not only had a huge impact on the petrochemical industry, but also has a huge impact on the global oil and gas industry as a whole. Since June 2014, the lower reaches of the hydrocarbon processing industry witnessed more than $130 billion of the project was canceled, shelved or delayed. This amount includes items that have been postponed, postponed or cancelled due to the decline in oil prices.

In the hold / cancel $130 billion project, about 27%, that is $35 billion in the petrochemical industry. These projects include a number of large capital projects, such as Qatar's Karaana Al and Sejeel Al petrochemical complex.

South Vietnam Binh Dinh province government announced on July 25, 2016 that, along with the delay for several years, Thailand has decided to cancel and PTT joint venture in quasi refinery and petrochemical complex project invested $20 billion to build the province. The project has been delayed for three years, along with other attractive investments that have affected its feasibility. The Renhai (Nhon Hoi) oil refinery and petrochemical consortium in Renhai Economic Zone, is expected to start in 2016. It is based on 400 thousand barrels / day refinery, to provide the feed of 1 million 400 thousand tons / year naphtha cracker, downstream equipment design and production totaled 5 million tons of petrochemical products. The initial plan was put into operation in 2021, but the delay has been postponed until 2025.

But anyway, every area is still investing in infrastructure development. These developments include the expansion, restart, transformation and construction of new facilities.

Two, the world petrochemical engineering Tour

1. Project construction in the Asia Pacific Region

The region has slowed in the past few years to announce new projects. In any case, the region will continue to dominate the overall construction projects of all sectors of the downstream industry, including the new petrochemical capacity.

China

China continues to invest heavily in chemical productionCapacity. According to the Boxscore database of hydrocarbon processing and construction, China has announced that the total capital expenditure of petrochemical projects in 2020 has exceeded 50 billion u.. This includes the new and the expansion of new petrochemical facilities, such as:

(1) China National Offshore Oil Corporation (CNOOC) and Shell's expansion project in the South China sea;

(2) Fujian Petrochemical Co., Ltd. Fujian petrochemical complex;

(3) Taixing ethylene plant (China's first gas cracking system) for SP olefins;

(4) as well as alternative / non conventional supply routes, such as coal chemicals (CTO), methanol to olefins (MTO) and propane dehydrogenation (PDH) projects.

However, these devices are conceived and constructed at high prices in crude oil prices. Now that oil prices have declined sharply, the MTO and PDH devices are facing the fierce competition of petrochemical production base. But in any case, China's MTO capacity will increase from about 1 million tons / year in 2017 to 6 million tons / year in 2014. China has also begun to operate more than 4 million tons / year of the CTO device, by 2018 there will be another 6 million ~700 million tons / year put into operation. PDH device construction is more strong, there are about 14 sets of new PDH devices have been planned or built. These devices represent more than 10 million tons / year of additional propylene production capacity.

India

Although China is the largest consumer of plastic in the Asia Pacific region, the fastest growth in demand is still in India. It is predicted that by the end of 2020, India's petrochemical industry will grow by an average annual rate of 8%~10%. Such a huge demand growth has been announced in the country to build additional petrochemical capacity. India plans to increase more than 3 million tons / year of new ethylene capacity by 2020. This will enable the country's domestic ethylene capacity increased to slightly more than 7 million tons / year. At the beginning of the 2020s total capacity is expected to increase more, India petrochemical complex Hindustan petroleum and Gale Company in Andhra Pradesh and new investment of $5 billion.

In addition, the India oil company announced in 2022 to invest more than $5 billion in new petrochemical. This includes additional polypropylene capacity in the Paradeep and Baroni refineries, and by 2020 to make its Panipat cracking unit expanded to 1 million 300 thousand tons / year. The country is also increasing the capacity of polyethylene terephthalate and refined acid, as well as other downstream petrochemical derivatives. This increase includes construction investment of billions of dollars of fertilizer projects. The surge in fuel demand for petrochemical products and refining, as well as the possibility of a major building boom in India, at least in the foreseeable future seems to be a new version of Chinese.

Malaysia

In Malaysia, ambitious refinery and petrochemical integration development (RAPID) projects continue to work. The project, which Pengerang integrated oil consortium second phase of the project, will include 300 thousand barrels / day refinery and petrochemical complex, the total capacity of all kinds of products is 7 million 700 thousand tons, and LNG regasification terminals. RAPID project estimated investment of $16 billion, while the cost of related facilities will be higher than $11 billion, the main contract has been signed, is expected to begin operation by the end of 2019.

The Republic of Korea

South Korea is investing in its downstream industry, focused on the petrochemical and oil refining expansion project. One of the most notable projects is the S-Oil company's residue modified consortium project (RUCP). The project is part of the company's strategic development plan, which includes the integration of refining and petrochemical. RUCP will convert heavy fuel oil into high value added gasoline and olefins. The project is composed of RUCP and the simultaneous construction of olefin. These two projects will serve as an integrated consortium. RUCP will provide the raw material for the production of olefin plant. The two projects are expected to be completed in the first quarter of 2018.

In the fourth quarter of 2014, SK Gas Co in Ulsan, Korea put into operation a $830 million investment in PDH devices. The 600 thousand tons / year device by the project partner SK advanced company (subsidiary of SK Gas Co), Petrochemical Industries Company of Kuwait and the Saudi Petrochemical Industries Co construction, commercial operation in the first quarter of 2016. Additional South Korea petrochemical projects including modern chemical company mountain petrochemical complex expansion, production 1 million tons of mixed xylene, and South Korea's Petrochemical Industries Co (KPIC) in South Korea Ulsan Onsan naphtha Center (NCC) expansion. KPIC plans to increase the production of ethylene in NCC nearly doubled, from 470 thousand tons / year increased to 800 thousand tons / year. Is expected to begin operation in the first quarter of 2017. Once completed, KPIC's ethylene production in South Korea's market share will increase from 6% to 10%.

Vietnam

Vietnam is making great efforts to invest in oil refining capacity in order to solve the shortage of domestic refined fuels. The country is developing several large projects. Most of these new refineries will be combined with a petrochemical plant. Yishan refinery and petrochemical complex investment of $9 billion will be in Vietnam second domestic refineries. The 200 thousand barrels / day refinery will be integrated aromatics and polypropylene facilities. Plan put into operation in 2018.

2. Project construction in the United States

The United States petrochemical industry is one of the largest industrial expansion in North America in the history of the United states. Capacity expansion, transformation, equipment and new facilities to re open the total investment has reached $130 billion.

U.S. Chemical Industry Council (ACC) tracking the United States 246 projects, the total value of 155 billion U.S. dollars, of which 64% are foreign direct investment. .

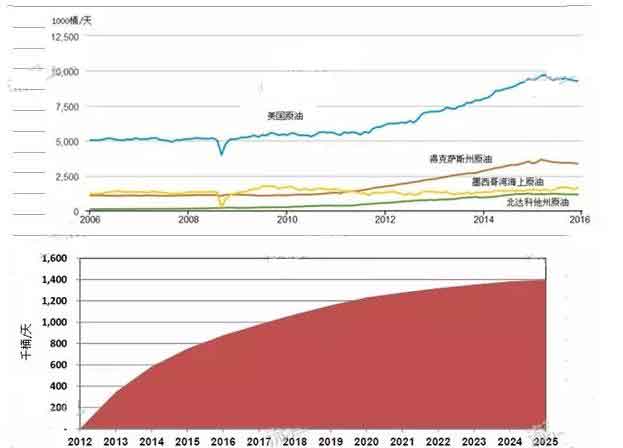

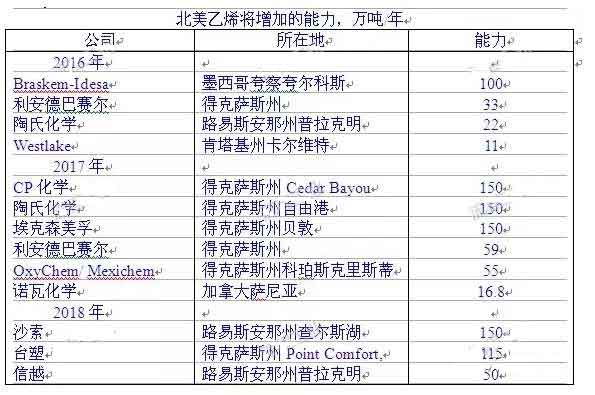

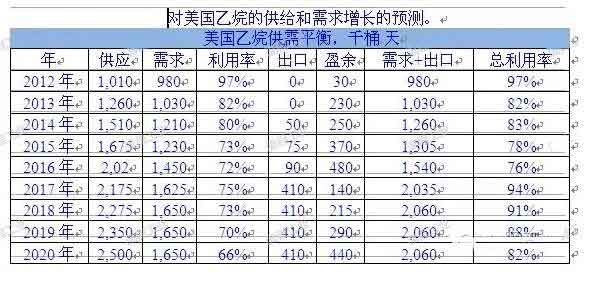

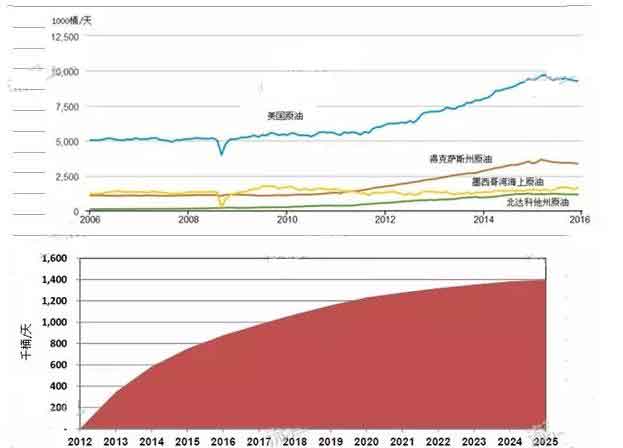

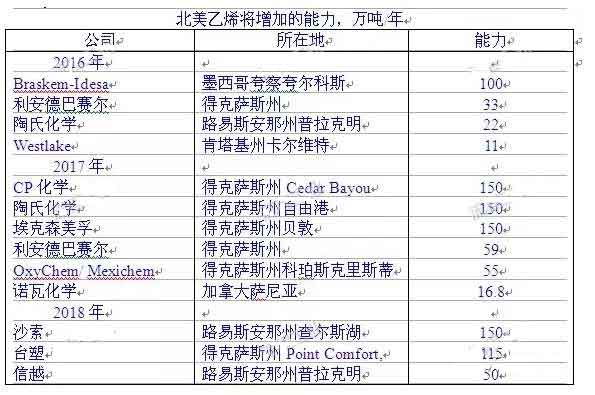

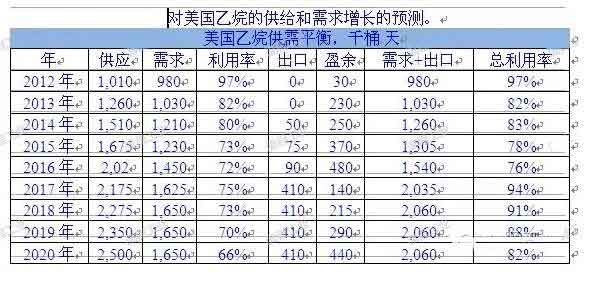

The biggest impact of the U. S. petrochemical construction industry is the surge in ethane cracking and the capacity of ethylene derivatives. The United States will increase ethylene production capacity of more than 8 million tons / year in 2019. Ethylene production capacity growth of the first wave of capital investment amounted to nearly $second, the 20 billion wave is expected to increase by early 2020s 8 million tons / year ethylene production capacity. Overall, the investment in the new ethylene production capacity is expected to reach $50 billion by 2022.

The American Chemical Council (ACC) in 2016In April 6th 2008, the number of U. S. chemical investment projects associated with shale gas revolution has reached 264. ACC pointed out that the potential investment of $40%, of which 164 billion have been completed or are in the process of planning, in the planning stage of 55%. ACC said, these projects could lead to new chemical industry output value reached 105 billion U.S. dollars / year, and support to the United States in 2023 738 thousand new permanent jobs, including 69 thousand new chemical industry jobs, 35.7 people and 312 thousand industry suppliers community employment.

The United States chemicals associated with shale gas exports to 2030 or will be doubled. The total value of U.S. chemical exports or from $60 billion in 2030 increased to $123 billion in 2014, while net exports are expected to grow from $19 billion 500 million in 2014 to $48 billion in 2030.

The United States has plans to build 10 sets of new ethane cracking unit, 8 sets of the United States in the Gulf of Mexico, 2 sets in the northeast of the United states. According to statistics, this shows that the capacity of about 12 million 500 thousand tons / year ethylene will be increased.

Chevron Phillips chemical company, Dow Chemical Company, Exxon Mobil Corp, Formosa, Sasol, Shell Companies and the Leander Ba Sell company and other companies in 2018 will make the United States a new ethylene production capacity increased by nearly 10 million tons / year. Some already announced ethylene plant expansion project, is expected to 2020 new ethylene production capacity of 3 million tons / year.

The innovation works company (NWIW) is owned by Chinese investors in the company (Shanghai BYK Clean Energy Technology Co. Ltd. (CECC) and Dalian Changxing Island Petrochemical Park joint venture), the company announced that significantly expanded methanol production capacity in the Pacific Northwest region of the United States investment and planning. Production will be shipped to Asia, especially in China. NWIW is planning to build a total of three locations in 8 large methanol production lines, each with a capacity of 5000 tons / day. This will enable the NWIW to have 14 million 400 thousand tons / year of methanol production capacity by boat to asia. The first two production lines in 2019 put into operation, all the other production line will be put into operation in two years. NWIW is the parent company of Shanghai Bi grams of clean energy technology (CECC) company, it is between Chinese academy and double green bridge Hongkong company partners, Hongkong double green bridge company was formed by members of the investment community management CECC. The company has signed with the Dalian West Zhuang Island Petrochemical Park, will supply the MTO facilities there, will also provide the Chinese coastal areas of the feed. The typical MTO production line uses 1 million 800 thousand tons / year of methanol to produce 600 thousand tons / year of olefins.

United States new synthetic ammonia urea production capacity is also surging. Has announced a new synthetic ammonia urea plant project investment of more than 16 billion u.. Most of the new production capacity will be located in the central and western regions, close to the center of agricultural demand. More than 5 million tons / year of new synthetic ammonia urea production capacity will be put into operation in 2016, and 6 million 800 thousand tons / year will begin operations in 2019.

Ethane as ethylene raw material will be exported to Western Europe and India

American enterprise products company (EnterpriseProducts) is building its terminal project, the United States is expected to start exporting a large number of ethane. The company has built the world's largest ethane terminal along the Gulf coast of Mexico. This is expected to start operations in the third quarter of 2016, has the ability to export ethane up to 240 thousand barrels per day (about 10 million Dun /nian), equivalent to the amount of three scale cracking device.

At present, the 3% use of the European cracking unit of ethane raw materials, this amount is equivalent to 50 thousand barrels / day of ethane consumption. Once the United States began to export ethane, 15% of the European ethylene production will begin using ethane as raw material. The amount of about 275 thousand barrels / day (about 11 million tons / year) ethane consumption.

India's largest petrochemical producer Xincheng Industrial Company has announced that it will make some of its use from the United States ethane cracking device. India oil company to develop a set of East Coast cracking unit, will be used from the United States shale gas ethane as raw material. India is considering the construction of a 1 million ~120 device in Orissa paradip million tons / year ethylene, the use of imported raw materials from the United states. The company will become the second India petrochemical company that imports the United States. The proposed cracking device will be a mixed feed device. The current plan is about 1 million tons / year from naphtha production of about 350 thousand tons / year of ethylene, 800 thousand tons and 800 thousand tons / year of ethylene oxide production imported from the United states.

3. Project construction in the Middle East

Over the next five years, the region will witness a substantial increase in its petrochemical capacity. This increase will include the ability of the new hybrid feed cracking unit, as well as the ethylene derivatives. Total capital expenditure in the Gulf region of the petrochemical industry is expected to reach 60 billion ~800 billion. Saudi Arabia, Kuwait and Oman will make the production of petrochemical products from 1.47 tons / year increased to nearly 200 million tons / year in 2021. Iran has begun to develop ambitious plans for the development of the petrochemical industry.

Saudi Arabia

Saudi Arabia will lead the Gulf region's petrochemical capacity increase. The country will invest more than $60 billion in downstream petrochemical projects in 2020. Large items of this investment will include capital intensive, such as PetroRabigh II, Sadara extended the Rabigh Consortium (mixed feeding cracking unit in the second quarter of 2016 began operating in Jubail), methyl methacrylate and poly methyl acrylate Waad Al Shamal device, phosphate and Ma’ Aden synthetic ammonia project, and Saudi Basic the Industrial Company of petroleum chemical project.

Kuwait

Kuwait is investing more than $30 billion in its clean fuel and new refinery (Al-Zour) program. In 615 thousand barrels / day of the Al-Zour refinery, the Kuwait Oil Company's subsidiary of the petrochemical industry Co., Ltd. will be integrated into an investment of $10 billion for the olefin III project, the device will include 1 million 400 thousand tons /The ethylene cracking unit and its derivatives unit is expected to be put into operation in 2020.

Oman

Oman also invested heavily in its petrochemical industry. Major projects include an investment of $4 billion for the Liwa plastic project, Sohar refined acid (1 million 100 thousand tons / year) and polyethylene terephthalate (500 thousand tons / year) complex, and Salalah synthetic ammonia device.

Iran

Iran is seeking to invest more than $70 billion to make its petrochemical production capacity to increase by two times in the middle of 2020. The country's goal is to make the petrochemical production capacity from 60 million tons / year to increase to 180 million by the end of 2020 tons / year. This includes the construction of more than 70 outstanding petrochemical projects in China, including new high-density polyethylene, ethylene glycol, polyethylene and sulfuric acid plant, as well as new synthetic ammonia, urea and methanol plant. If Iran's ambitious plans are to be achieved, the country will need to attract foreign investors to complete the technology and construction experience.

4. Project construction in Europe

Active petrochemical projects in Europe to increase the capacity of Eastern Europe to lead. Eastern Europe accounted for nearly 80% of the petrochemical engineering construction in the region. This is mainly from Russia and the CIS (CIS) project to lead.

In the CIS, however, some ambitious plans to halt the petrochemical. This includes some capital intensive projects, such as the KPI company in Kazakhstan natural gas chemical Atyrau Atyrau Consortium; SOCAR company in Azerbaijan near Baku Petrochemical Association, which is part of the country's large scale OGPC projects. SOCAR has announced that it will spend about $1 billion 300 million to transform the existing refinery and petrochemical complex, and continue to carry out the transformation of the North Sumgait petrochemical plant in Baku.

In any case, the progress of the CIS in a number of projects will increase the petrochemical production capacity. This includes the Turkmenistan Kiyanly petrochemical complex and Garabogaz fertilizer plant, Ustyurt in Uzbekistan natural gas chemical plant (late in 2015), and in Azerbaijan, Turkmenistan and Uzbekistan - additional synthetic ammonia urea plant. A total of more than 7 billion u..

Most of the region's petrochemical capital spending is in Russia. Russian Chemical Company West bull company will complete the ZapSibNeftekhim petrochemical complex (ZapSib-2) project. The project is located in the west of the company in the Tobolsk polymer production base 3 km north of the north, in early 2015 to build. The project will be composed of 1 million 500 thousand tons / year ethane cracking unit and ethylene derivative unit. Once completed, the consortium will be Russia's largest polymer production base.

Russian oil company subsidiary of the Far East Petrochemical Company Limited (FEPCO) plans to build the largest integrated refinery and petrochemical complex near the Nakhodka City, the Far East Federal District of the country. The consortium will include 12 million tons / year refinery, which will supply raw materials to the newly built petrochemical complex. Once completed in early 2020s, the facility will provide the local market in the Far East of Russia, as well as the use of its proximity to the Asian market to meet the demand for petrochemical products.

Ineos is Europe imported from the United States only ethane cracker operators, it has taken measures to establish pipeline across the Atlantic to transport ethane, the company began to make the United States imported into Europe from 2015 began to ethane. Ineos has begun construction of Europe's largest tank to import raw materials in the United States - Granger Merce. The huge storage tank diameter of 56 meters, 44 meters high, with a capacity of 108 thousand and 372 cubic meters.

Ineos has been completed in early 2015 to build a new tank based on Rafnes ethane production. The tank from the second quarter of 2015 for the first time storage of ethane. At the same time, the company is studying in the UK Ineos, Grangemouth unit construction ethane terminal, the device can handle ethane imports from the United States, for the production of large base cracking unit consumption.

The chemical company also with Denver city in the U.S. state of Colorado (Antero Resources) antero resources company signed a 10 year agreement, will be from the United States to the supply of ethane in Sweden Stenungsund (Stenungsund) of the flexible steam cracking device. Nordic chemical company shipped 240 thousand tons / year from the United States of america.

Versalis will enable the company in Dunkirk (Dunkirk) to improve the flexibility of the raw material of steam cracking device, the device uses a low cost from the United States imported ethane as raw material. The Dunkirk cracker will be able to use ethane in 2016, accounting for the ethylene yield up to 50%.

5. Project construction in Latin America

China and the United States and South America in the past ten years has a huge growth. Projections show that the region will increase demand in the time of 2020 years ago. Latin American countries have been hit hard by the fall in oil prices, especially in countries that rely heavily on oil exports. The decline in revenues has made the expansion of oil refining and petrochemical industries limited. In the short term, these countries will meet demand through imports, rather than spend billions of dollars to invest in major expansion or new facilities. This trend does not mean that the region's petrochemical projects in the blank.

Mexico

One of the most aspiring project, is in the area of Mexico at the beginning of the project put into operation, the investment of $5 billion 200 million for the Etileno XXI project for hydrocarbon processing project in 2015 the top award, representing 20 years in major petrochemical projects in Mexico's first private sector. The new union is located near the Mexico Veracruz Coatzacoalcos Nanchital, developed by Braskem Idesa company, has 1 million tons / year ethane cracker and two sets of high density polyethylene plant (750 thousand tons / year), a low density polyethylene plant (300 thousand tons). The facility began operations in March 2016, and the target is positioned to meet the inkWest Columbia in the growing demand for polyethylene. XXI Etileno project is expected to replace 2 billion U. s.dollars of imports of polyethylene, as raw materials for agriculture, automotive, construction and consumer industries.

Tobago - Trinidad

Tobago - Trinidad is the world's largest exporter of synthetic ammonia, the second largest exporter of methanol. The country has 11 sets of synthetic ammonia plant and 7 sets of methanol plant. The country's $1 billion investment in the construction of a new set of methanol and two methyl ether production unit. This project is developed by MITSUBISHI gas chemical company, Mitsubishi Co and MITSUBISHI Heavy Industries Company and Massy holding company and Tobago Trinidad state owned natural gas company. The project laid the foundation stone in September 2015 after additional financing guarantee. The facility will be located in La Brea (Brea La), with a total capacity of 1 million tons / year of methanol and 2 million tons / year of two methyl ether. The device is expected to start operations in the first quarter of 2019.

Brazil

Brazil Petrochemical outlook bleak. Oil refining and petrochemical expansion plans have been severely cut because of cost overrun, huge debt, weak economy, loss of revenue from the lower reaches of the government and corruption scandals.

Peru

Peru continues to support the new petrochemical complex in the southern part of the country. A $3 billion 500 million investment in Arequipa petrochemical project (Arequipa) will be used from central Peru Camisea gas pipeline materials. The project provides raw materials for future free Odebrecht company to build a $5 billion investment in natural gas pipeline. If completed, the petrochemical complex will produce about 1 million 200 thousand tons / year pe.

bolivia

The increase in domestic natural gas production in Bolivia is driving the country's ambitious plans for a substantial increase in petrochemical production capacity. Bolivia national Oil Natural Gas Corp YPFB has developed a new expansion plan, so that the value of oil and gas products to become self-sufficient in 2022. The country is close to the first phase of the national strategy. Nearly $2 billion plan (phase 1) including: refinery expansion; LNG device; synthetic ammonia urea device, synthetic ammonia urea device is the first in Bolivia petrochemical complex, to produce 420 thousand tons of synthetic ammonia and 645 thousand tons of urea in the device, the supply of the domestic market, began operation in July 2016.

6. Project construction in Africa

Most of the major capital intensive projects are located in Egypt and Nigeria.

Due to strong domestic demand for polymer and petrochemical products, Egypt is investing more than $two to build 7 billion 500 million petrochemical complex. Egyptian carbon holding company is Tahrir petrochemical complex investment $7 billion. The facility will be located in Sokhna Ain. Once completed, the association will be the world's largest naphtha cracker. The device will produce up to 1 million 500 thousand tons / year of ethylene, as well as ethylene derivatives. Scheduled to be completed in 2019.

Sidi Kerir (Sidpec) is a Petrochemical Industries Co petrochemical complex port construction investment of $600 million 200 thousand tons / year. The facility is expected to put into operation by the end of 2018.

In Nigeria, the Petrochemical new capacity is mainly around the growing agricultural industry. That includes billions of dollars of projects by Brass fertilizer, Indorama and Dangote industries. A total of more than 6 million tons / year synthetic urea production capacity, is expected to put into operation in mid 2018.

Process equipment network finishing release, reproduced please indicate the source.