Hydrogen has been touted as the fuel of the future. Now it is finally possible to translate its potential into reality.

The International Energy Agency (IEA) recently released a blockbuster report on the future of hydrogen, which states that today hydrogen is catching up with unprecedented momentum of development. The world should not miss this unique opportunity to make hydrogen an important component of clean and safe energy for the future. & rdquo;

Sources of hydrogen

Almost all sources of pure hydrogen come from fossil fuels. 6% of global natural gas and 2% of global coal are used for hydrogen production. As a result, hydrogen production results in about 830 million tons of carbon dioxide emissions per year, equivalent to the total carbon dioxide emissions of Indonesia and the United Kingdom. As far as energy is concerned, the annual global demand for hydrogen is about 330 million tons of oil equivalent, which is larger than Germany's main energy supply.

At present, about 70 million tons of special hydrogen are produced, 76% of which comes from natural gas, and the rest comes from coal.

Annual hydrogen production consumes about 2050 cubic meters of natural gas and 107 million tons of coal.

Electrolytic water currently accounts for 2% of global hydrogen production, but there is much room for more low-carbon hydrogen in the future.

Today's hydrogen production costs vary greatly from region to region, and its future economy depends on factors that will continue to change in the region, including the prices of fossil fuels, electricity and carbon.

At present, the cost of hydrogen production from low carbon energy is very high. Analysis by the International Energy Agency (IEA) found that the cost of hydrogen generated by renewable energy could drop by 30% by 2030 due to the reduction in the cost of renewable energy and the expansion of hydrogen production. Fuel cells, fuel reforming and electrolysis can all benefit from mass production.

Use of hydrogen

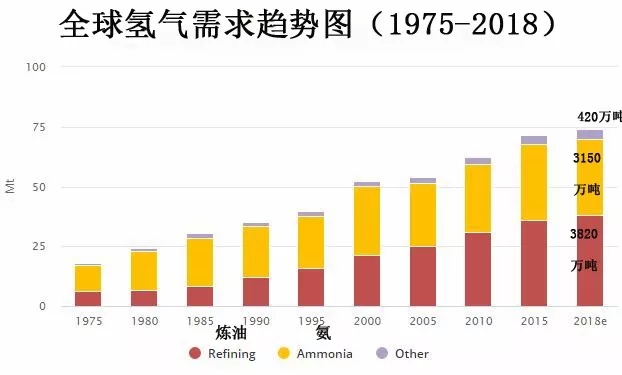

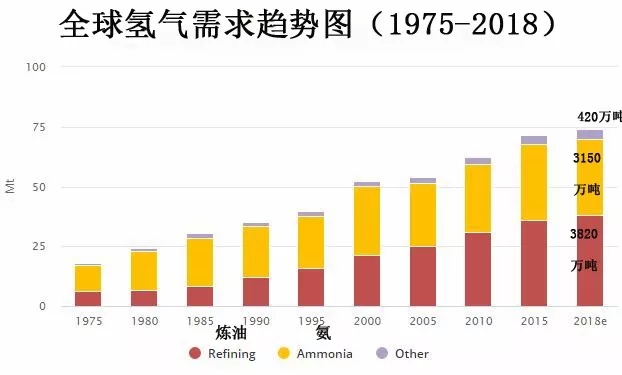

In particular, the report points out that hydrogen is currently mainly used in oil refining and fertilizer production. Demand for hydrogen has more than tripled since 1975.

Today's hydrogen use is mainly industrial. At present, the four single uses of hydrogen are oil refining (33%), ammonia production (27%), methanol production (11%) and direct reduction of iron ore (3%) to produce steel. In fact, all of this hydrogen is supplied by fossil fuels.

At present, more than 60% of hydrogen used in refineries is produced by natural gas. By 2030, stricter air pollutant standards could increase the use of hydrogen in refineries by 7% to 41 million tons per year. Petroleum demand for hydrogen is expected to remain high in the next decade.

Currently, global refining capacity is generally considered sufficient to meet growing oil demand, which means that most of the future hydrogen demand may come from existing facilities equipped with hydrogen production facilities.

Demand for ammonia and methanol is expected to increase in the short to medium term, and new capacity will provide an important opportunity to expand low-emission hydrogen channels. Increasing efficiency can reduce overall demand levels, but this will only partially offset demand growth.

By 2030, the potential hydrogen consumption for building heating will be as high as 4 million tons.

Power generation offers many opportunities for hydrogen and hydrogen-based fuels. Under the low capacity factor of flexible power plants, the cost of hydrogen below $2.5 per kilogram has great competitive potential.

Iron and steel and high-temperature heat generation provide great potential for the growth of demand for low-emission hydrogen.

Limited options for low-carbon fuels provided by the shipping and aviation industries provide opportunities for hydrogen fuels.

The competitiveness of hydrogen fuel cell electric vehicles depends on the cost of fuel cells and the construction and utilization of gas stations.

Four Opportunities and Seven Key Suggestions

The report stresses that there are some challenges in hydrogen application - mdash; & mdash; existing production technologies are causing pollution and high costs, while hydrogen itself is volatile and highly flammable - mdash; & mdash; because in the context of climate change, the energy industry is increasingly pressing to respond to the call for decarbonization. It suggests that policies must now be put in place to support early investment needed to reduce costs and expand the size of the industry.

The IEA has identified four key areas for market advancement, including:

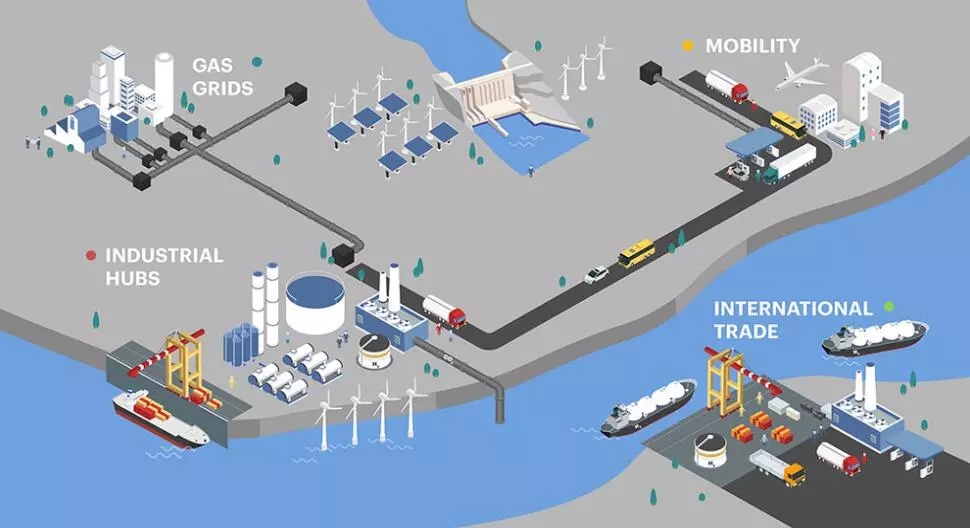

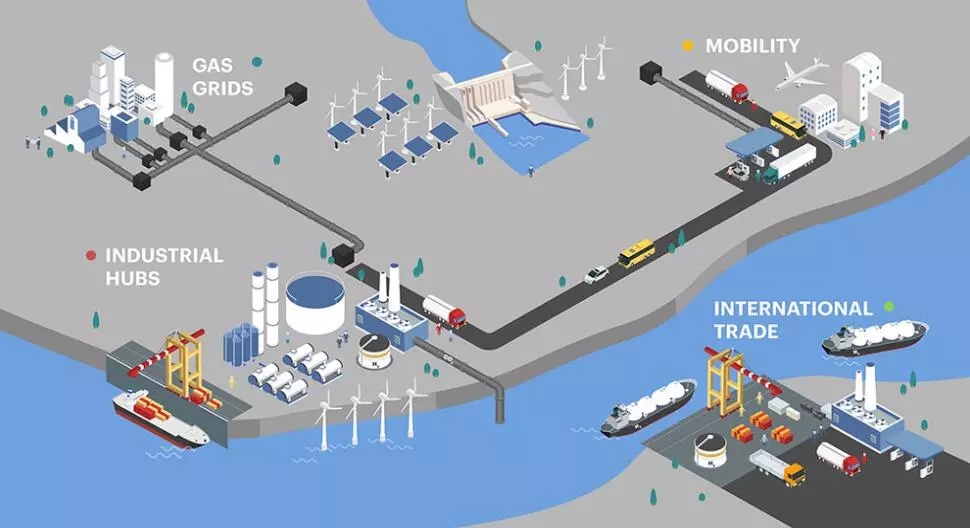

1. Make industrial ports an expanding use of clean hydrogen-ldquo; nerve centre-rdquo;.

2. Build on existing infrastructure, such as natural gas pipelines of millions of kilometers.

3. Expanding hydrogen transport through fleets, freight and transport corridors

4. Open the first international route of hydrogen industry.

As a road map for the future, IEA has made seven key recommendations:

1. Establish the role of hydrogen energy in the long-term energy strategy. National and local governments should guide future expectations, and companies should have clear long-term goals. Major industries include oil refining, chemical industry, steel, freight and long-distance transportation, construction, power generation and storage.

2. Stimulate commercial demand for clean hydrogen. Clean hydrogen technology has applicability, but the cost is still challenging. Policies need to be developed to create a sustainable market for clean hydrogen, especially to reduce emissions from fossil fuel hydrogen production, in order to support investment by suppliers, distributors and users. These investments can reduce costs by expanding supply chains, whether for low-carbon electricity or for carbon capture, utilization and storage of fossil fuels.

3. Solve the investment risk of & ldquo; pioneer & rdquo. New applications of hydrogen energy, as well as clean hydrogen supply and infrastructure projects, are at the most dangerous point in the deployment curve. Targeted and time-bound loans, guarantees and other instruments can help the private sector invest, learn and share risks and returns.

4. Support R&D to reduce costs. In addition to cost reduction in economies of scale, R&D is also critical for cost reduction and performance improvement, including fuel cells, hydrogen-based fuels and electrolytes (technologies for hydrogen generation from water). Government actions, including the use of public funds, are essential for setting research agendas, taking risks and attracting private capital for innovation.

5. Eliminate unnecessary regulatory barriers and harmonize standards. Because regulations and licences are required.The project developer faces obstacles to progress because of unclear requirements, inappropriate for new uses, or inconsistencies across departments and countries. Knowledge sharing and harmonization of standards are key to solving the problem, including equipment, safety and emission certification from different sources. The complex supply chain of hydrogen systems means that governments, companies, communities and civil society need regular consultation.

6. Participate in international activities and follow up progress. There is a need to strengthen comprehensive international cooperation, especially in the areas of standards, good practice sharing and cross-border infrastructure. Regular monitoring and reporting of hydrogen production and use are needed to track progress towards long-term goals.

7. Focus on four key opportunities to further enhance the momentum of the next decade. By building existing policies, infrastructure and skills, these mutually supportive opportunities contribute to expanding infrastructure development, enhancing investor confidence and reducing costs:

Make full use of existing industrial ports and transform them into low-cost, low-hydrocarbon distribution centers.

Use existing natural gas infrastructure to stimulate new clean hydrogen supply.

Support transport fleets, cargo and corridors to make fuel cell vehicles more competitive.

Establish the first shipping route and start the international hydrogen trade.