The 2017 global merger and acquisition cases continued to be high.

As the Dow Chemical and DuPont merger has become the largest chemical enterprise merger cases in 2017, and Chinese chemical group completed the acquisition of Swiss agricultural giant Syngenta trading is China enterprises in overseas biggest acquisition. Next, we are listed in the successful acquisition of mergers and acquisitions in 2017.

The combination of DuPont and DuPont with Dow chemistry

In December 2015, the two largest chemical companies in the United States, DuPont, reached an equal merger agreement with Dow Chemical (DowChemical). They will become the largest chemical company in the world with a market value of 130 billion dollars. This is the biggest deal of mergers and acquisitions in the global chemical industry so far. Two the existing shareholders will own about half the shares after the merger.

At the end of August 2017, Dow Chemical and DuPont Co finally completed the merger, which is named “ Dow DuPont ” (DowDuPont) the global new company after the merger, company annual sales reached $77 billion, the stock market value of more than $150 billion, employees reached 100 thousand people. But this marriage is transient, because according to the original plan, 18 months later, the company will also be divided into three industry-leading and independent listed companies, which are engaged in agriculture, special products and chemical materials business.

It is understood that DuPont DuPont's board of Directors consists of 16 members — — 8 directors from the original DuPont board of directors, and 8 directors from the original Dow board. Among them, the board has two chief directors: JeffreyFettig, who was previously the chief independent director of Dow's board of directors, and AlexanderCutler was previously the chief independent director of DuPont's board.

Chinese chemical group completed the acquisition of Syngenta

In February 2016, the Chem China announced that it had agreed to buy the Swiss Agro and seed company, Syngenta, through an open offer. The offer price is $465 per share. The total value of Syngenta issued capital gold is $43 billion. China chemical said Syngenta operation and management of integrity and employee will fully support, including its headquarters remain in Basel Switzerland, and in the next few years to re listed company.

In June 2017, the China National Chemical Corp announced the completion of the acquisition of Syngenta Syngenta's headquarters in Switzerland, Basel. The chairman of China chemical group Ren Jianxin was elected chairman of the board of directors of CEO Syngenta Syngenta, Eric · fyrwald (ErikFyrwald) will remain. Syngenta will achieve 5 years in some of the stock listed. The transaction was completed, marking the new height of China's overseas mergers and acquisitions.

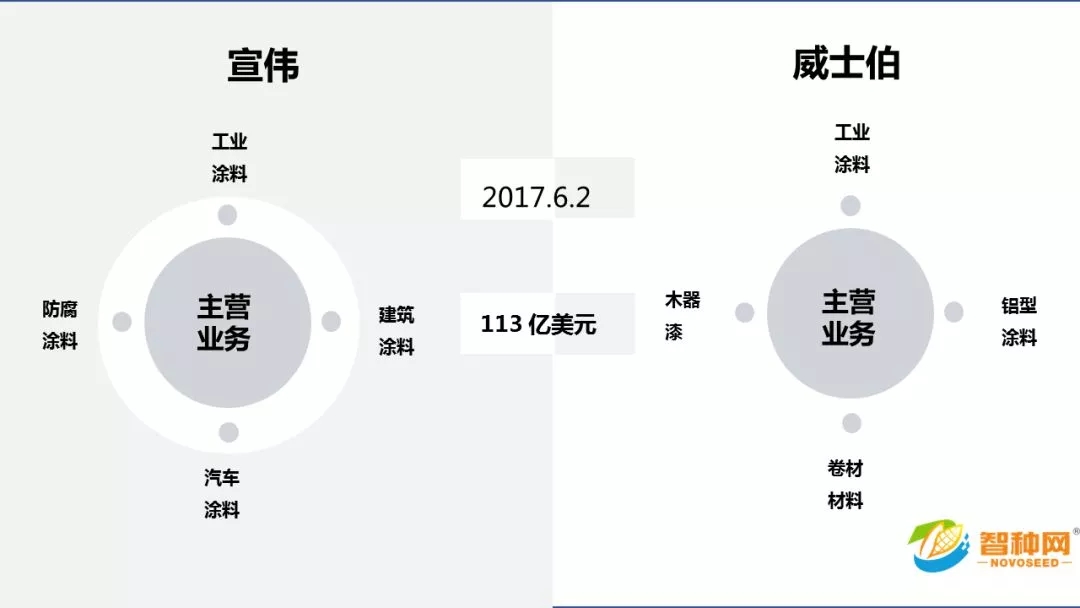

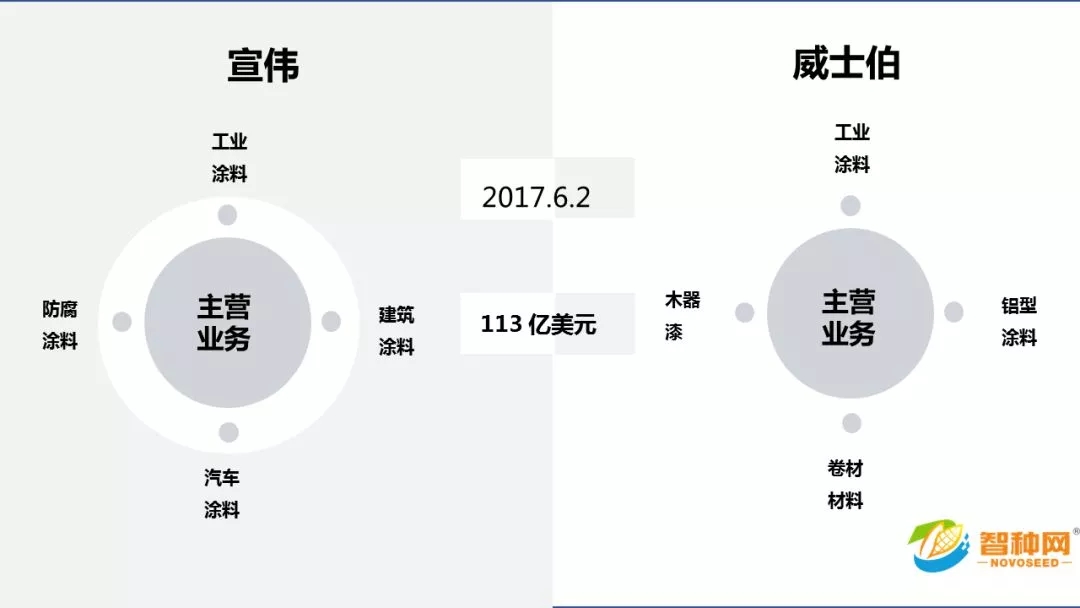

Xuan Wei completed the acquisition of Valspar

In March 2016, American paint giant Xuan Wei (Sherwin-Williams) agreed to buy Valspar (Valspar) with about $11 billion 300 million in cash. In 2015, the combined revenue of the two companies was $15 billion 600 million. If the merger is completed, it will go beyond PPG industry and become the world's largest paint maker, with a revenue of $15 billion 300 million in 2015.

In June 2017, Xuan Wei announced that the company had completed the acquisition of Valspar. The company's headquarters is located in Cleveland, Ohio, with an estimated income of $15 billion 800 million in 2016 and about 60000 people in the world. In the field of industrial coatings, the company is a global leader in the fields of packaging coatings, roll coatings, general industrial coatings and industrial wood coatings.

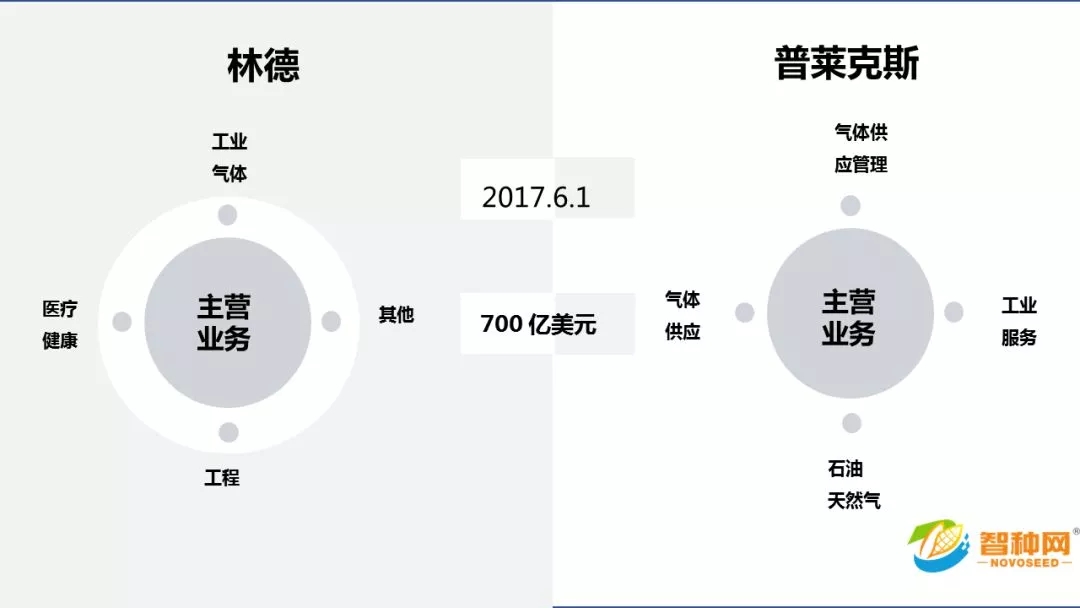

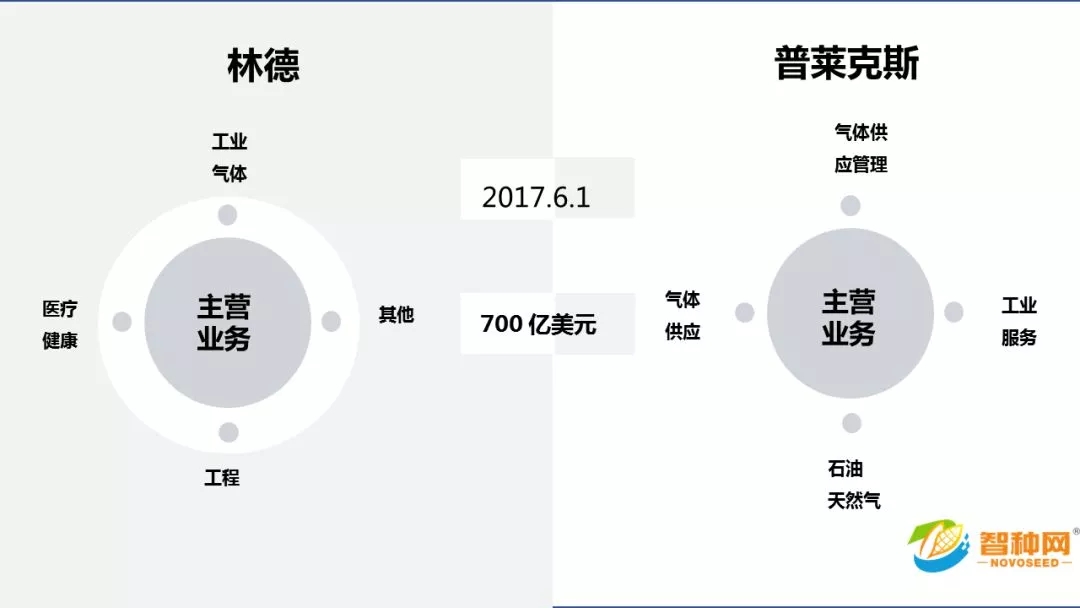

Lind and Praxair signed a merger agreement

In December 20, 2016, German Linde industrial gases group (Linde) and the United States Pulaikesi (Praxair) announced that the two companies have signed all stock merger agreement holding equivalence. The company will become the leader of the global industrial gas industry. The combined revenue of 2016 is about 29 billion dollars, and the stock market value is more than 70 billion dollars. The new holding company will be named Linde, which is registered in Ireland, and most of the corporate governance activities, including the board of directors, will be carried out in the UK. At present, Linde and Praxair's shareholders will have approximately 50% stake in the company after the merger. The merger has been reached in December 2016, but it has been deadlocked since Linde's labor representatives strongly opposed mergers and acquisitions, and thought that the relocation of headquarters to Germany would weaken its influence.

The merged company will also have two stocks listed, one in New York and one in Frankfurt. Praxair CEO SteveAngel will serve as the new company after the merger of CEO. German Linde CEO Wolfgang Reitzle will be the chairman of the board at the appointed time.

Our school 6 billion acquisition of Claus Maffei

Tianhua Institute announced that the company intends to 6 billion 641 million yuan acquisition of actual control of Chinese chemical industry's assets, and the assets, the most eye-catching is the acquisition of the German company Claus Maffei (hereinafter referred to as KM) holding company equipment is universal, the transaction price reached 5 billion 967 million yuan, accounting for the total acquisition price of 89.85%. The deal behind the German capital as the world's first German industrial 4 and 2025 Chinese manufacturing promotion fund, and in the chemical industry and in the new united together, participate in and manage this historic transaction.

Manchester tenole acquisition

An American company (Tronox) announced in February 21st, will be $1 billion 673 million in cash and 24% shares of class a common stock company of Saudi Arabia Koster (Cristal) titanium dioxide business,The company also announced its intention to start selling its alkali chemical business unit Alkali.

With Tronox and Cristal titanium dioxide business will create the world's largest and highest level of integration of the new titanium dioxide industry leading enterprises, the combined company will operate a total of 8 countries in the world 11 titanium dioxide plant, total production capacity reached 1 million 300 thousand tons / year, in one fell swoop than previous titanium dioxide industry leading company of mu (Chemours, DuPont original titanium technology).

At present, the company is Interroll and the European Commission to discuss a series of agreements to purchase titanium dioxide. And Saudi Arabia needs to negotiate. While the U.S. Federal Trade Commission filed a request to stop the acquisition Kesite tenole.

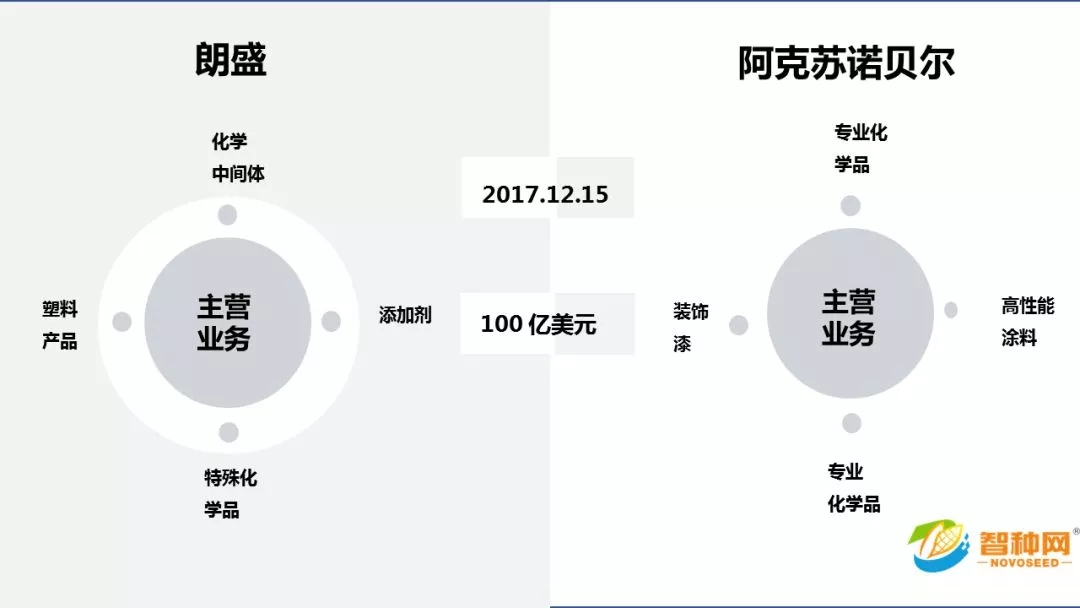

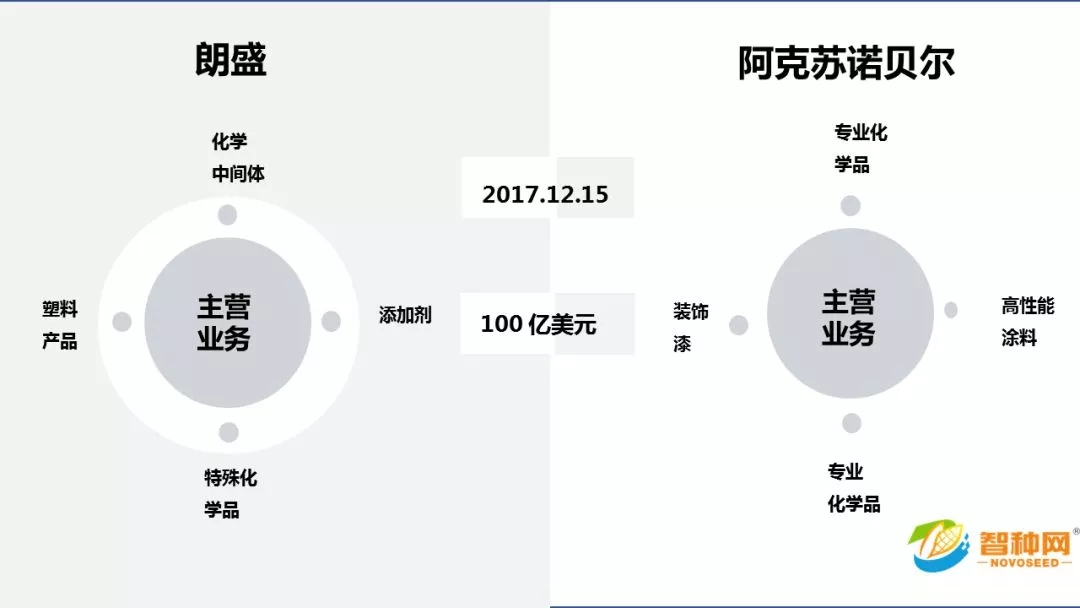

LANXESS to buy AKZO NOBEL specialty chemicals

Germany LANXESS (Lanxess) has teamed up with private Holdings Company bid for AKZO NOBEL Apollo global management company (Akzo Nobel) $10 billion worth of specialty chemicals business.

Reported that Germany LANXESS CVC capital partners, including KKR, Advent and Bain Capital International (BainCapital), team competition; in addition, the Carlyle Group (CarlyleGroup) and the Blackstone Group (BlackstoneGroup) will conduct a separate tender. Data shows, LANXESS is a leading specialty chemicals company, including the core business development, production and sales of chemical products, intermediates, specialty chemicals and plastics additives. In 2016, sales were 7 billion 700 million euros, with about 19200 employees worldwide and 74 production bases in 25 countries.

Thailand polyester industry giants and DuPont Teijin signed a purchase agreement

2017 October Thailand polyester industry giants for Dora (Indorama) DuPont Teijin company has and the signing of the acquisition agreement, the acquisition is successful, because the company will receive eight production assets Dora DuPont Teijin in the United States and Europe and the China.

According to the current progress, it is expected that the transaction will be completed by the end of 2017 or early 2018.

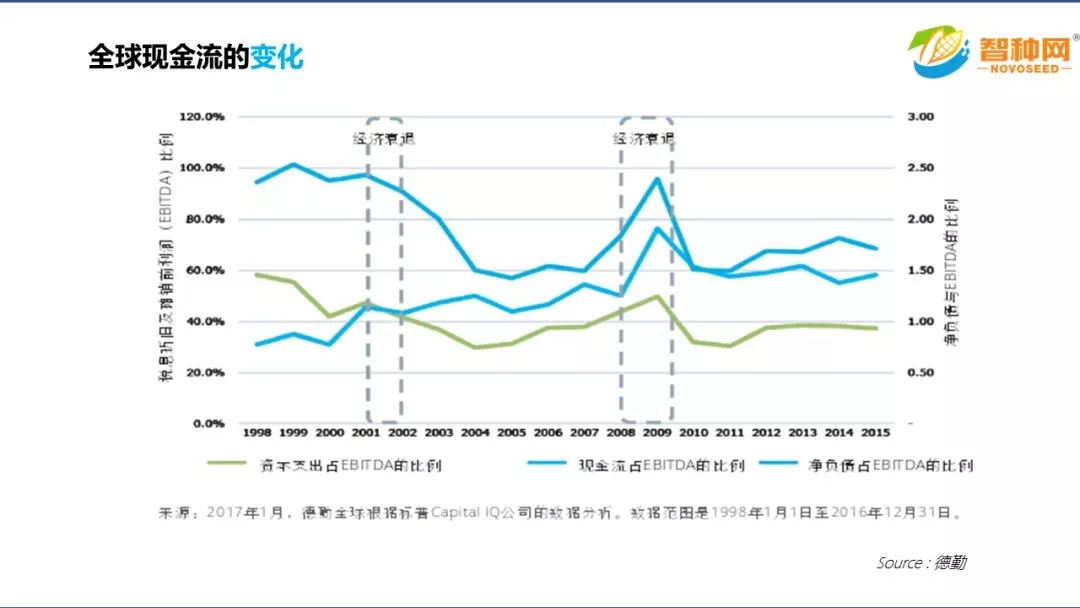

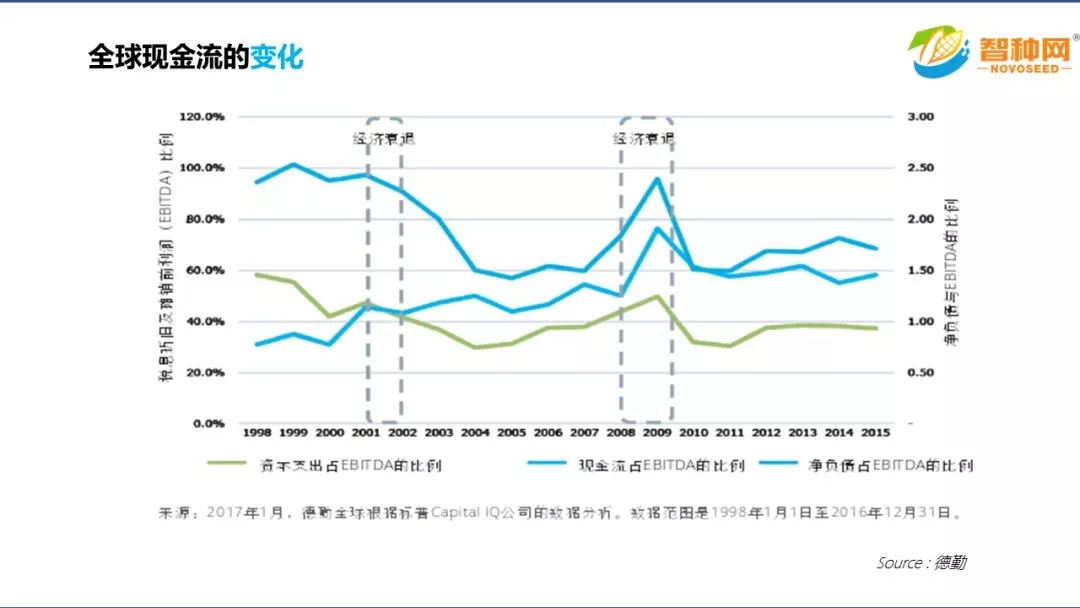

Since 2009, the global economic recession since the capital leverage ratio increased gradually, and the level of corporate cash and capital investment is still relatively stable, mature chemical industry to decline in investment demand, coupled with excess capacity, reduce the cash return rate of investment, reduces power investment in new capacity.

Although the credit and affordability of chemical companies are relatively high in the past few years, they may not have the incentive to speed up capital expenditure to achieve future benefits. However, the ratio of net debt to EBITDA that leverage is rising gradually, retention of cash in international business gradually increased, the potential change and Trump's new deal until the end of last year to accelerate cash buyback, cash is still high, the stock market rate of return is difficult to predict, the chemical enterprise can take the cash for the acquisition. This has caused the 2017 global merger and acquisition cases to continue to be hot.

Many companies are paying more and more attention to innovation, such as BASF. Dow chemistry. DuPont, Evonik industries and Syngenta, taking advantage of corporate venture capital (CVC) innovation. The main purpose of these CVC investment objectives: current or future focus on innovation; pursue additional technology, create new solutions to promote the development of the global trend; meet the needs of sustainable development, such as, food, and water resources, and access to new opportunities in developing countries. Many companies want to use this way of investing to speed up innovation and stimulate growth. Meanwhile, the entire chemical industry is turning to technology to promote innovation and improve operational efficiency, hoping to bring more growth and additional profits with more digital technology.

The source of wisdom for | network NOVOSEED, ID:iNovoseed

| produced editing network finishing process equipment