In April 2nd, the State Council Tariff Commission issued a declaration in the early morning to impose tariffs on 128 imports of the United States. A vigorous trade war was officially struck. But China's chemical industry has not begun to respond, and American chemicals have begun to warn Trump. Why is this? Let's take a look at the situation.

The trade war between China and the United States

On March 22nd, President Trump signed the presidential memorandum, according to “ 301, investigated ” as a result, it would impose large tariffs on Chinese imports and restrict Chinese enterprises to invest in the US. Trump claims that the size of Chinese goods involved in taxation is up to $60 billion.

It is impolite not to reciprocate. The Chinese side immediately announced the equivalent measures of 50 billion US dollar commodities such as soya, chemicals and aircraft imported from the United States.

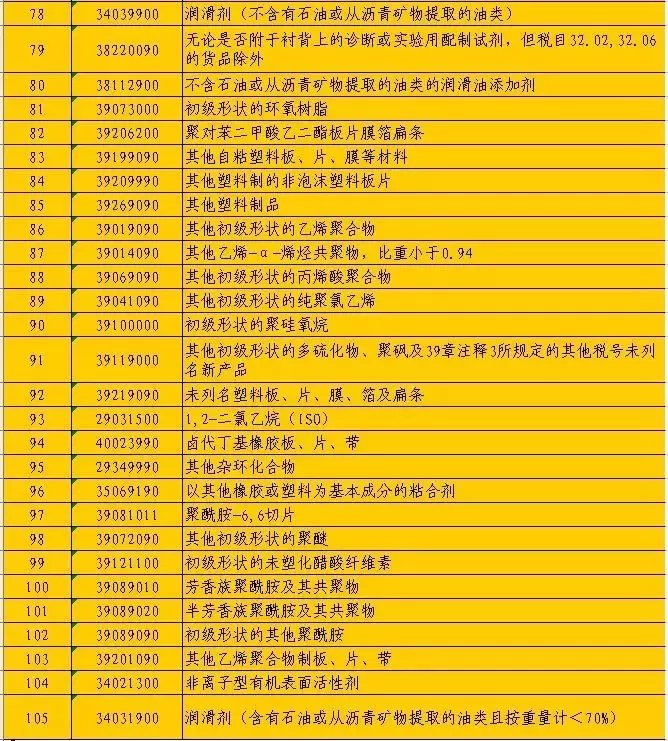

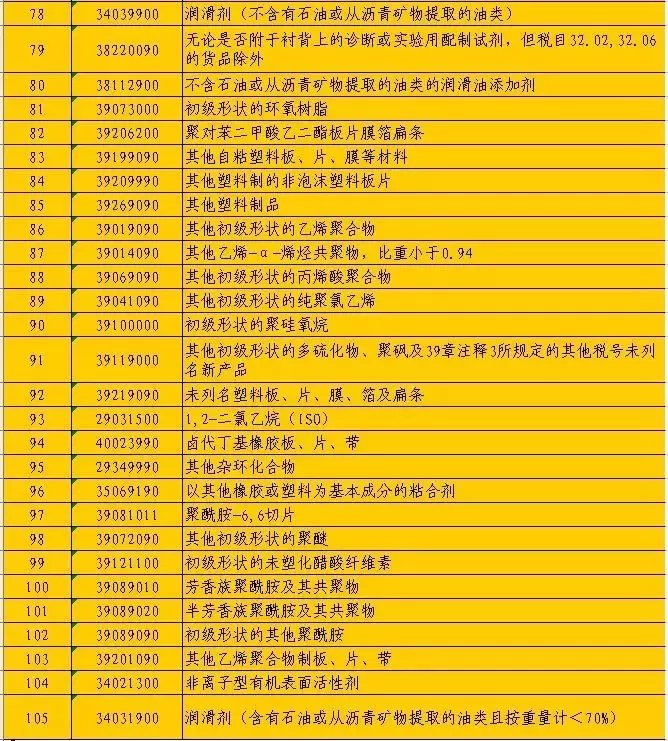

Chinese announced tariffs in listing 40% is chemical products, including polyethylene (PE), polycarbonate (PC1850 billion), polyvinyl chloride (PVC), acrylonitrile (ACN), catalysts, lubricants, epoxy resin, acrylic polymer, vinyl polymer and polyamide etc..

The chemical industry in the United States has strongly urged all parties to try to avoid the outbreak of trade war. At the same time, industry people generally believe that once the tariff policy is implemented, the chemical market in the United States and the world will be impacted.

Jeopardize US $185 billion in Chemical Investment

The US chemical Council (ACC) warns that China's tariff measures will seriously threaten the chemical industry in the United States.

The statement released on Wednesday by ACC said China's tariff list 40% is a chemical product, including PVC and plastic. Last year, China imported 11% of the American plastic resin, with a value of $3 billion 200 million.

ACC, representing DuPont, DuPont and other major chemical companies, said that members of the company were built, expanded or restarted in the United States at the current tariff level. The total investment is up to $185 billion, and the trade war with China jeopardizes these plans.

ACC is called “ American chemical manufacturers believe that free and fair trade should be applied to all members of the WTO. However, it is not the answer to trade war with one of the most important trading partners of our country. ” “ we strongly urge the government of the United States and the Chinese government to take measures, ” (prevent) the further escalation of this situation.

In recent years, with the coming of the shale oil and gas drilling boom, the cost of key raw materials such as ethane has been reduced. Chemical production has become the biggest driving force for the growth of the US manufacturing industry. American chemical plants use cheap natural gas like ethane, more competitive than other naphtha producers.

According to the statistics of ACC, this advantage has prompted chemical producers to announce that they invest 185 billion US dollars to produce chemical products in the United States, and more than half of them have not yet started construction. And the changes in the market caused by the tariff hike may help investors to do business elsewhere.

But the new tariff is not the only threat. Even before the latest round of tariffs, Chevron Phillips chemical companies are also increasingly worried about rising construction costs, which is a threat to another American project plan. In the past five years, the cost of building has risen by 40%.

China's tariffs impacted the global chemical market

According to ICIS, a foreign industry website, a number of chemical industry executives and industry analysts believe that once the tariff policy is implemented, it will impact the chemical market in the US and the world.

International eChem chairman Paul Hodges said: "&ldquo"; China has clearly indicated that it does not want to trade war, but it will not shrink back if Trump wants to fight. China has more than one year's plan. For this, you can see that the tariff is very pertinent. ”

China does not mention the specific date of the entry into force of the 25% tariff, which should be an effective bargaining chip against US tariff measures. “ explicitly requiring chemical … … may be more warning, not a major damage to industry. The flow of trade will be quicker. Most chemical enterprises have production bases in China, &rdquo, Jefferies, Jefferies Laurence analyst Alexander.

However, analysts expect that China's tariffs will not affect the price of the United States, as the proportion of the chemicals listed in the US exports is small. For example, only 6% of LDPE and LLDPE products are exported to China, and half of them are professional.

Bernstein Chemical Analyst Jonas Oxgaard said it is strange that styrene and ethylene glycol — — the two largest export of chemicals from the United States to China is not on the list; &rdquo.

However, the United States is preparing to meet the PE production tide during the period of 2018~2019, a large part of which is for export. The tariffs include linear low density polyethylene (LLDPE), low density polyethylene (LDPE) and medium density PE (MDPE), but not high density polyethylene (HDPE).

LLDPE is probably the most affected polymer, which accounted for 4.3% of the output of the United States to China in 2017.

If American chemical products move elsewhere from China, the global price war is getting easier, such as Europe.

Hodges thinks, “ the United States will not stop production. The possibility of a price war is already very high. Once the tariff is implemented, it is almost sure. ” “ the room has two giant — — an integrated producer based on ethane and an integrated producer based on oil refining products. They are running out [full speed]. Everyone thinks this is the best alternative, andAnd be fast. ” the polyethylene products in the United States will be extremely uncompetitive after their tariffs are imposed in China.

The opposite view is that global PE prices may rise. “ if China buys goods outside the United States, American producers will fill the resulting market gap, said &rdquo, an analyst at Cowen, an analyst at Cowen. “ this may make the product more expensive, because it will fill the Chinese market by a number of customers. In the end, it may push up global prices because the US price has just risen by 25%”

China's tariffs can affect us polyethylene production capacity, and can also limit the additional global production capacity.

Frank Mitsch, an analyst at Wells bank, has called on investors to maintain their original perspective. The United States is “ a very favorable ” the market, because ethane produces 1 pounds of ethylene only 13 cents, naphtha method needs 42 cents / pound / / pound.

Trump tried to cool down a trade war

The opening of the second round of trade war between China and the United States made the U.S. stock market plunge early, and the Dow fell by 500 points at one time.

The Trump Administration tried to cool down the panic in trade war. The White House economic adviser, Larry ·. Kudelo, emphasized that the commodity tariff measures announced by the United States were still only a suggestion and may never come into operation.

“ tariff measures is only recommended, not yet implemented, ” kudla said in an interview Wednesday. “ we are asking for advice. At least two months to take action. ”

Officials of the Trump administration have stressed that the United States is willing to negotiate with China all day, which has eased investors' worries about the Sino US trade conflict. The Dow Jones Industrial Average fell more than 2% on Wednesday at the beginning of the market, closing up nearly 1%. But after the market panic, the Dow ended up about 230 points, and the amplitude of the day was nearly 800. The NASDAQ rose about 1.6%, the S & P rose 1.3%. Tesla was up 7%, Amazon was up about 1.3%, Facebook fell 0.65%, and digital currency fell sharply.

The US Commerce Minister said the Sino US trade problem could eventually be settled through consultations.

WTI Wednesday, May crude oil futures fell 0.22%, at $63.37 / barrel. Brent's June crude oil futures fell 0.15% to $68.02 / barrel.

U.S. Commerce Secretary Ross said that the Sino US trade issues may eventually be resolved through consultations; the new tariff Chinese only equivalent to GDP 0.3%, so it was not a fatal blow to the United States; Ross is not surprised Chinese will make a counter to the U.S. tariff, but Wall Street was surprised by the trade friction response to his.

President Trump issued a tweet on Wednesday morning: “ we did not trade with China. The war was lost many years ago by politicians who were stupid and ineffective. Now our trade deficit is $500 billion a year, and intellectual property theft is also a loss of $300 billion. We can't let such a situation continue! ”

Source: sinohua new network