At present, how much profit can a factory run in China make it profitable after paying taxes? If you earn 400 thousand, you may be less than 30 thousand. Where did all the money go? Is it a profit or a loss? Today, the little editor to help you calculate ~ ~

400 thousand yuan for Maori,

Less than 30 thousand??

For example, the factory has a sales income of 2 million yuan, and the total cost of rent, wages, office, materials and equipment is 1 million 600 thousand yuan and gross profit is 400 thousand yuan. Entrepreneurs burst into ecstasy, earning 400 thousand yuan, good … … however, if all taxes and fees were paid, the result was only 21 thousand and 400 yuan. You didn't mistake it for 21 thousand and 400 yuan (not 214 thousand yuan), would you like to cry? The list of specific income, costs and taxes is as follows:

Suppose you have opened a chemical plant. One year, the following business conditions are as follows:

The workshop is rented and covers an area of 2000 square. What is discussed is pre tax rents. The relevant taxes and fees are held by the tenants. The monthly rent of the workshop is 10 thousand yuan (pre tax) and the annual rent is 120 thousand.

The raw material is bought, and it costs 100 thousand yuan.

The company has two cars, a truck loaded with 5 tons for delivery, and a 2.5 liter car for office use. The cost of gasoline is 40 thousand yuan a year.

The expenses of employees (including wages, bonuses, social security, withholding personal income tax, etc.) cost a total of 1 million 100 thousand yuan.

Water, electricity, gas, communications and office expenses cost 150 thousand yuan.

Equipment maintenance and depreciation 90 thousand yuan.

This year, 2 million yuan (including tax) has been sold.

How much money can I make this year? Did you make 200-12-10-4-110-15-9 = 40 (ten thousand)?

Of course not!

Where's the other 370 thousand?

You have to pay taxes first. How many taxes should be paid below:

Tax 1: Tax and fee for renting a factory

Business tax: 12*5% = 0.6 (ten thousand)

Urban construction tax: 0.6*7% = 0.042 (10000) (which is lower in urban tax rates, lower in town, 5%)

Additional education fee: 0.6*3% = 0.018 (ten thousand)

Property tax: 12*12% = 1.44 (ten thousand)

Land use tax:

Take Guangzhou as an example, Guangzhou's industrial land tax rate is divided into five stalls: 15 yuan, 12 yuan, 8 yuan, 5 yuan, and 3 yuan.

According to the standard of grade three land, 8 yuan per square metre per year.

2000*8 = 16 thousand

Stamp duty: 120 thousand *1‰ = 120

The total tax and fee of the above rented plant are as follows:

0.6+0.042+0.018+1.44+1.6+0.012 = 3.71 (ten thousand)

Tax 2: car and boat tax

720+480 = 1 thousand and 200

Tax 3: stamp duty

0.3&permil for purchase and sale contracts (excluding VAT);

200/ (1+17%) *0.3‰ = 0.05 (ten thousand)

Tax 4: VAT

(200-200/ (1+17%)) - (10-10/ (1+17%)) = 27.61 (10000)

Tax 5: urban construction tax — — VAT 7%

16.15*7% = 1.93 (ten thousand)

Tax 6: education fee plus — — value added tax 3%.

16.15*3% = 0.83 (ten thousand)

Tax 7: local education fee plus — — value added tax 1%.

16.15*1% = 0.28 (ten thousand)

The above 1~7 tax and fee are total:

3.71 + 0.12 + 0.05 + 27.61 + 1.93 + 0.83 + 0.28 = 34.53 (10000)

The following calculation of pre tax profits is the tax base of corporate income tax. When calculating the income tax, VAT shall not deduct the cost. Therefore, when calculating pre tax profits, no value added tax can be used to offset costs.

Pre tax profit = 200/ (1+17%) -12-10-4-110-15-9-3.71-0.12-0.05-1.93-0.83-0.28 = 4.02 (10000)

Tax 8: enterprise income tax, tax rate 25%

Pre tax profit *25% = 4.02*25% = 1.01 (ten thousand)

The following enterprise profits after tax are calculated: 4.02-1.01 = 3.01 (10000)

If we want to raise the profits of the enterprises, we should share the profits as the owners' personal income. The individual income tax should be paid for the dividends.

Tax 9: personal income tax, tax rate 20%

3.01*20% = 0.6 (ten thousand)

The business owner finally got the money: 3.01-0.6 = 24 thousand and 100. If it is spread to 12 months, the monthly income is 2008 yuan. The above has not yet calculated the social insurance premiums that business owners should pay to themselves. If the standard of Guangzhou is 2016~2017, at least one thousand yuan per month should be paid for social security.

In this way, the owner's disposable income is only a few hundred yuan a month. You thought there was a 400 thousand profit for the whole year. In fact, under such a thin profit, the whole year was basically dry.

In the above calculation process, the total tax paid by the owners is: 34.53+1.27+0.76 = 36.56 (10000).

And there is at least one more tax: petrol tax. According to the oil price and tax rate of gasoline in March 92, 2016, every 100 yuan of gasoline contains 50.36 yuan. The middle age spent 40 thousand yuan on oil money, including oil tax:4*50.36% = 2.01 (ten thousand)

In this way, the annual tax payment is 36.56+2.01 = 38.57 (10000).

What's more, the 385 thousand and 700 tax includes only the taxes paid by enterprises and owners, and has not yet included the personal income tax paid by employees. In this case, according to the difference between the number of employees and wages, the total amount of personal income tax paid may be between tens of thousands of yuan and hundreds of thousands of yuan.

This case tells us that at present, in our country, it is difficult for small profits to survive. If you want to do it, you need to do a profiteering industry.

The wages of the workers were 7000 yuan,

In fact, the boss gave 14000 yuan!

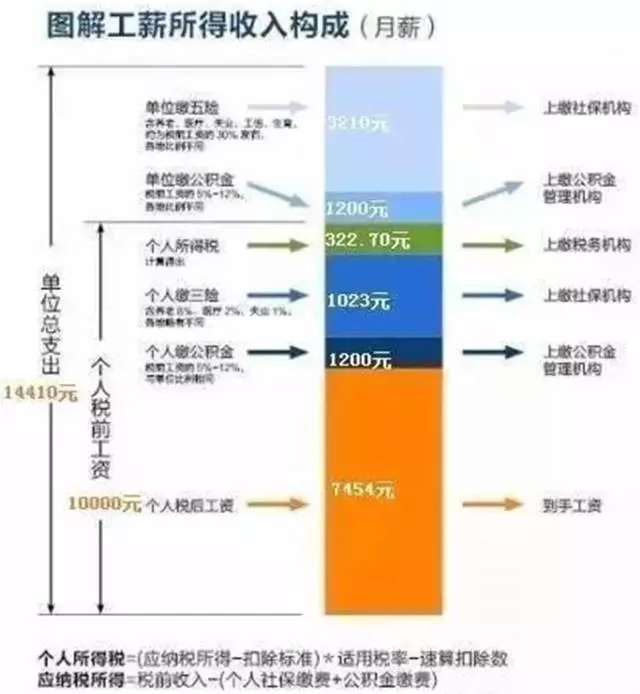

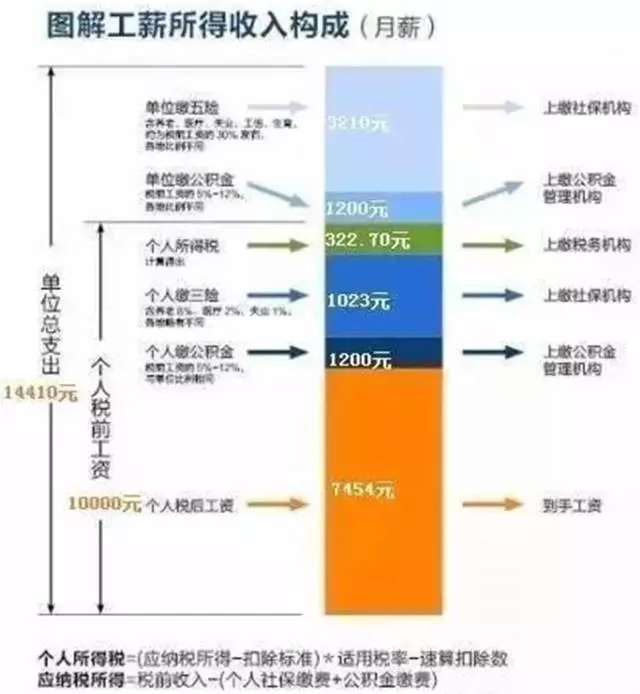

The monthly salary of employees is 10 thousand, deducting the five risks and one gold tax, actually it reaches 7454 yuan, but the boss actually pays 14410 yuan.

Many people complain that their work is tired, the work is hard, the salary is still low, you know, in fact, you get the salary of the hand, but after a few tax passes to your hands. So how many layers did it go through?

Why are wages actually not low, but very few hands?

The monthly salary is 10 thousand, you can only get 7454.30 yuan, and your boss will pay 14410 yuan. Today, Xiaobian wants to tell you a cruel reality: the wages you get are actually less than 60% of the total wage.

And, more cruelly, next, it may go down.

Who “ buckle the ” your salary?

Although they are all &ldquo, they are distressed by the pain of &rdquo.

1, a lot of tears are all tears

The monthly salary is 10 thousand, you can only get 7454.30 yuan, and your boss will pay 14410 yuan.

Recently, Ma Kai, vice premier of the State Council, said that the current pension insurance premium level is high, “ five risks one gold ” it has accounted for 40% to 50% of the total wage. That is to say, the wages you get are less than 60% of the total wage.

So, where are all the remaining 40% differences left?

1 the monthly salary before tax is 10 thousand, the five risks one gold, the personal tax will be 6955.70 yuan.

The monthly salary of 10 thousand yuan, a monthly five risk one gold and a tax plus 6955.70 yuan, it seems that there seems to be a problem, some people may ask, plus pay a tax, can not get 3000 yuan after tax. This is not knowing that the five risks and one gold are mainly paid by enterprises besides the personal payment.

Personal payment - social insurance and provident fund payment details: pension 8%:800 yuan; medical 2%:203 (200+3) yuan; unemployment 0.2%:20 yuan; provident fund 12%:1200 yuan. A total of personal contributions: 2223 yuan. Personal tax: the total amount of tax payable is 4277 yuan, and the personal tax is 322.70 yuan.

Social security and provident fund payment details: pension 20%:2000 yuan; medical 10%:1000 yuan; unemployment 1%:100 yuan; industrial injury 0.3%:30 yuan; birth 0.8%:80 yuan; provident fund 12%:1200 yuan. Unit contribution: 4410 yuan.

From the above calculation, we can know that the total income is 10000-2223 to 322.70=7454.3 yuan, and the total amount of unit labor expenditure is 10000+4410 = 14410 yuan.

The employer pays 14410 yuan a month, and the employee gets 7454.30 yuan. Where is the difference between 6955.70 yuan? The following will be illustrated by a chart.

The five insurance units paid by the unit, 3210 yuan and 1023 yuan per person, paid the social security institution; the unit paid and individual paid 1200 yuan each, and turned over the fund management institution; the individual income tax was paid to the tax institution by 322.70.

When you get a monthly salary of 10000 yuan before tax, the actual amount of cash you get is 7454 yuan, accounting for 51.73% of the actual labor cost of the enterprise, which is more than half of the total of 14410 yuan. The amount of money that an enterprise needs to pay is about two times that of the individual.

It's time to be amazed. Does it make us jumpy? Do you know where the money is going this time?

Source: mechanical frontline and so on