The China Federation of Petroleum and Chemical Industries recently released a report on the economic operation of the whole industry in November 2018. The report shows that the economic operation of the petrochemical industry slowed down in that month. The growth of production and consumption is basically stable, the growth rate of added value has fallen back; the supply and demand of the market is stable, and the rise of the overall price level has been hindered; profits have maintained a relatively rapid growth, costs have continued to decline, and the overall efficiency of the industry has continued to be good. The economic growth structure has been further optimized and the ability to resist risks has been enhanced. The report predicts that in 2018, the main business income of the whole industry will be about 12.65 trillion yuan, an increase of about 13% compared with the same period last year; the total profit will exceed 900 billion yuan, a record high, an increase of about 30%.

The report points out that from January to November 2018, the added value of the petrochemical industry increased by 4.7%; the main business income increased by 14.6% to 11.71 trillion yuan, and the growth rate fell by 0.4 percentage points from January to October. The growth rate of the main business income of oil and gas, refining and chemical industry sectors was 22.5%, 23.9% and 9.7% respectively; the total profit was 8508 billion yuan, an increase of 35.9%, which slowed down by 5.9 percentage points compared with the previous October. In addition, export slowed down and stabilized, with the export delivery value of 629.312 billion yuan in the first 11 months, an increase of 20%. Investment in the chemical industry continued to rebound. Fixed assets investment in the chemical raw materials and chemicals manufacturing industry increased by 5.8% in the first 11 months, 3 percentage points faster than that in January-October, the third consecutive month of growth accelerated, and the rebound trend continued to strengthen.

The report also points out that international oil prices have fallen sharply since October 2018, with the volatility of the petrochemical market increasing and some commodity prices falling sharply. In addition, the global trade restriction policy continues to increase, the domestic petrochemical industry investment momentum is still insufficient, and the market demand for major chemicals is also weak.

The report predicts that in 2018, the business income of petrochemical owners will be about 12.65 trillion yuan, an increase of about 13% compared with the same period last year; among them, the business income of chemical owners will be about 7.55 trillion yuan, an increase of 9%. It is estimated that the total profit of the petroleum and chemical industry will exceed 900 billion yuan in the whole year, a record high of about 30% increase, of which the total profit of the chemical industry will be about 500 billion yuan, an increase of 15%. It is estimated that the total export volume of petrochemical industry in the whole year will be about US$212 billion, an increase of 10% over the same period of last year.

November 2018 Petroleum and Chemical Industry Economy

Operation report

In November 2018, the economic operation of the petroleum and chemical industries slowed down. The growth of production and consumption is basically stable, and the growth rate of added value has fallen back; the supply and demand of the market is stable, and the rise of the total price level is hindered; profits keep growing fast, costs continue to decline, and the overall efficiency of the industry continues to be good; the structure of economic growth is further optimized, and the ability to resist risks is enhanced. However, the market fluctuates greatly, some commodity prices have fallen sharply, the industry investment power is still insufficient, and the market demand for major chemicals is weak.

I. Completion of Major Economic Indicators

From January to November 2018, the added value of the petroleum and chemical industries increased by 4.7%; the main business income increased by 14.6% to 11.71 trillion yuan, and the total profit increased by 35.9% to 850.8 billion yuan; the total output of petroleum and gas increased by 1.8% to 302 million tons (oil equivalent); and the total output of major chemicals increased by about 2.5%.

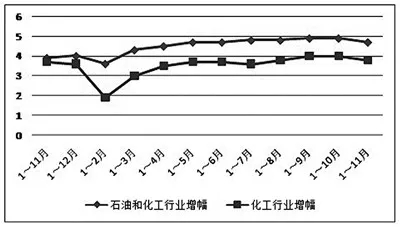

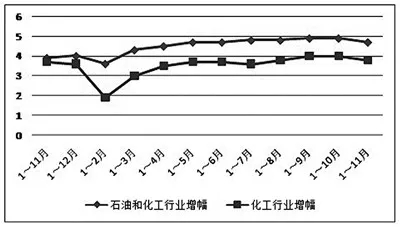

(1) The growth rate of added value has slowed down and income has remained basically stable.

By the end of November, there were 27 835 Enterprises above the scale of petroleum and chemical industries, and their cumulative value-added increased by 4.7% year-on-year. The growth rate dropped by 0.2 percentage points from January to October, which was lower than the increase rate of 1.6 percentage points of the national value-added of scale industry in the same period. Among them, the added value of the chemical industry increased by 3.8%, slowed down by 0.2 percentage points from January to October; the oil and gas exploitation industry increased by 4.3%, accelerated by 0.1 percentage points; and the refining industry increased by 6.5%, dropped by 0.3 percentage points.

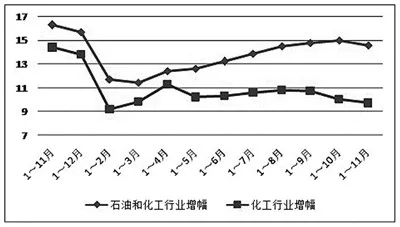

From January to November, the main business income of the petroleum and chemical industries was 11.71 trillion yuan, up 14.6% year-on-year, and the growth rate dropped 0.4 percentage points from January to October.

Among the three major sectors, the business income of chemical industry owners was 6.94 trillion yuan, an increase of 9.7% year on year, a drop of 0.3 percentage points from January to October; the business income of refinery owners was 3.62 trillion yuan, an increase of 23.9%, a drop of 0.4 percentage points; and the business income of oil and gas extraction owners was 907.14 billion yuan, an increase of 22.5%, a drop of 0.4 percentage points.

In the chemical industry, the main revenue of coal chemical products, synthetic materials manufacturing and chemical mining and dressing increased rapidly, reaching 19.4%, 14.1% and 13.2% respectively. The main revenue of basic chemical raw materials, special chemicals and coatings (pigments) increased by 12%, 9% and 6.9%, respectively. The growth rates of manufactures of fertilizers, pesticides and rubber products were 5.3%, 11.9% and 1.3%, respectively.

From the growth structure of main revenue, the contribution rate of basic chemical raw materials manufacturing is the largest, 34.9%, synthetic materials manufacturing 28.6%, and special chemicals manufacturing 19.6%.

(2) Energy production continued to accelerate, and the output of major chemicals remained basically stable.

From January to November 2018, the total output of crude oil and natural gas in China was 302 million tons (oil equivalent), an increase of 1.8% over the same period last year, and the growth rate was 0.2 percentage points faster than that in January to October, while the total output of major chemicals increased by about 2.5% and fell by 0.1 percentage points.

Crude oil production declined and natural gas growth accelerated. In November, China's crude oil output was 15.534 million tons, down 1.3% from a year earlier; natural gas production was 14.27 billion cubic meters, up 10.1%, and liquefied natural gas production was 837,000 tons, up 7.9%. In the same month, China's crude oil processing volume was 504.577 million tons, an increase of 2.9%, and its refined oil output was 30.527 million tons, an increase of 0.3%. Among them, diesel oil production was 14.674 million tons, down 6.2%; gasoline production was 12.09 million tons, up 7.1%; kerosene production was 3.844 million tons, up 7%.

The overall growth of key chemicals was basically stable. OneIn January, China's ethylene output dropped by 6.2%, methanol output by 3.973 million tons, paint output by 5.4%, chemical reagents by 4.2%, sulphuric acid production by 5.7%, caustic soda production by 2.839 million tons, by 30%, calcium carbide production by 2.325 million tons, by 10.3%, synthetic resin production by 7.154 million tons, and synthetic fibre production by 16%. The output of vinyl monomers was 3.733 million tons, down 1.2%, while that of tyres was 72.62 million, down 2.1%.

Agricultural chemicals production overall rebounded. In November, China's fertilizer output (reduced to 4.8 million tons, the same below), a slight decrease of 1% over the same period last year. Among them, the output of nitrogen fertilizer was 2.853 million tons, down 6.6%; that of phosphorus fertilizer was 1.21 million tons, down 2.4%; that of potassium fertilizer was 73.7 million tons, up 33.5%. In the same month, the output of pesticide raw materials (100%) was 210,000 tons, an increase of 8.8%. In addition, agricultural film production was 103,000 tons, down 6.4%.

(3) The growth rate of energy consumption continues to accelerate

From January to November 2018, the total apparent consumption of crude oil and natural gas in China was 817 million tons (oil equivalent), an increase of 8.7% year on year, and the growth rate was 0.4 percentage points faster than that in January to October.

Among them, the apparent consumption of crude oil was 588 million tons, an increase of 5.7% over the same period last year, 0.3 percentage points faster than that in January-October, and the external dependence was 70.6%. The apparent consumption of natural gas was 253.66 billion cubic meters, an increase of 17.4%, an increase of 0.5 percentage points, the largest increase in the year, with an external dependence of 43.3%.

In the first 11 months, the apparent consumption of refined oil was 297 million tons, an increase of 1.4%. Among them, the apparent consumption of gasoline is 117 million tons, an increase of 5.1%; kerosene is 34.2 million tons, an increase of 11.1%; diesel is 146 million tons, a decrease of 3.3%.

(4) Slow and steady export

In November 2018, petroleum and chemical industry regulated enterprises completed export delivery value of 57.937 billion yuan, an increase of 10% compared with the same period last month, a decline of 2.8 percentage points, an increase of 5% annually. Among them, the export delivery value of petroleum and natural gas exploitation industry was 160 million yuan, an increase of 23.4%; the export delivery value of petroleum processing industry was 109.5 billion yuan, an increase of 6.9%; and the export delivery value of chemical industry was 44.728 billion yuan, an increase of 10.2%. From January to November, the export delivery value of the whole industry was 629.312 billion yuan, an increase of 20%. Among them, the export delivery value of chemical industry was 49.2259 billion yuan, an increase of 12.8%.

In the chemical industry, the export of pesticides and basic chemical raw materials continued to grow rapidly, while the growth of rubber products accelerated. In November, the export delivery value of pesticides and basic chemical raw materials increased by 23.5% and 17.3%, respectively; the export delivery value of rubber products increased by 7.7%; the export delivery value of synthetic materials and special chemicals increased by 9.5% and 9.2%; the export delivery value of fertilizers increased by 0.1%; and the export delivery value of coatings and pigments decreased by 7.7%.

(5) Investment in the chemical industry continues to rebound

From January to November 2018, the investment in fixed assets in chemical raw materials and chemicals manufacturing industry increased by 5.8% year on year, 3 percentage points faster than that in January to October. In the same period, the growth rate of industrial investment in China was 6.4%, 0.4 percentage points faster than that in January-October.

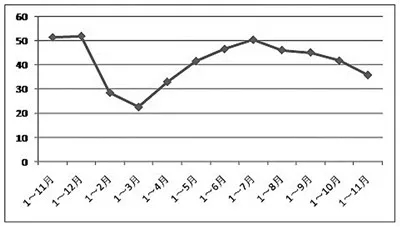

II. Professional Benefits

The economic benefits of petroleum and chemical industries are generally good, but the growth momentum is slowing down. From January to November 2018, the total profits of the petroleum and chemical industries reached 850.8 billion yuan, an increase of 35.9%, a slowdown of 5.9 percentage points compared with the previous October, accounting for 13.9% of the total profits of large-scale industries in the same period. The main income cost per 100 yuan is 81.49 yuan, down 0.72 yuan from the same period last year; the industry loss is 17.2 percent, down 0.4 percentage points from January to October; the total assets is 12.98 trillion yuan, up 6.1 percent; the asset-liability ratio is 54.3 percent, down 1.21 percentage points from the same period last year. From January to November, the profit margin of the main business income of the whole industry was 7.27%, up 1.14 points from the same period last year, and the gross profit margin was 18.51%, up 0.72 points. The turnover days of finished products are 16 days, and the average payback period of accounts receivable is 29.7 days.

(1) Strong recovery of oil and gas recovery

Profit has maintained a momentum of recovery growth. From January to November 2018, 285 enterprises in oil and gas exploration industry achieved a total profit of 177.19 billion yuan, an increase of 346.9% over the previous year, accounting for 20.8% of the total profits of the petroleum and chemical industries. Among them, the total profit from oil exploitation was 132.25 billion yuan, an increase of 12.2 times; the total profit from natural gas exploitation was 42.17 billion yuan, an increase of 39.3%.

Unit costs continued to decline, and the situation of loss-making enterprises was basically stable. From January to November, the operating cost of oil and gas exploitation owners was 57.22 billion yuan, an increase of 0.1% over the same period of last year; the cost of main business income per 100 yuan was 63.08 yuan, a decrease of 14.13 yuan over the same period of last year. Among them, the main operating cost of oil exploitation 100 yuan income was 58.35 yuan, down 18.3 yuan; the main operating cost of natural gas exploitation 100 yuan income was 50.1 yuan, down 4.35 yuan. In the first November, the loss of oil and gas exploitation industry was 32.3%, which was 0.4 percentage points larger than that in January-October; the loss of loss enterprises was 21 billion yuan, down 69.8% from the same period last year; the total assets was 2.25 trillion yuan, up 3.4%; the ratio of assets and liabilities was 43.3%, down 354 percentage points from the same period last year; the accounts receivable was 112.99 billion yuan, up 19%, significantly faster than that in October; the capital of finished products was 12.25 billion yuan, up 0.3%. The data also show that from January to November, the financial cost of oil and gas exploitation industry decreased by 12.9%, while the management cost increased by 12%.

From January to November, the profit margin of the owner's business income of oil and gas exploitation was 19.53%, which was 14.18 points higher than that of the previous year.36.92%, up 14.13 points. The turnover days of finished products are 6.6 days, and the average payback period of accounts receivable is 32.8 days.

(2) The fluctuation of oil refining industry benefits began to increase

Profit growth slowed sharply. From January to November 2018, 1210 enterprises in the refinery industry achieved a total profit of 183.25 billion yuan, an increase of 4.4% over the previous year. The growth rate fell by 12.5 percentage points from January to October, accounting for 21.5% of the total profits of the petroleum and chemical industries.

The rise of unit cost continues to accelerate, and the loss of the industry has expanded. From January to November, the operating cost of oil refining owners was 2.89 trillion yuan, an increase of 28.8% over the previous year, which was higher than the income growth rate of 4.9 percentage points; the main operating income cost per 100 yuan was 79.86 yuan, an increase of 3.05 yuan from the previous year, an increase of 0.35 yuan from January to October. In the first November, the oil refining industry lost 23.2%, an increase of 0.6 percentage points from January to October; the loss of loss enterprises was 9.53 billion yuan, up 27.4% from the same period last year; the total assets was 2.25 trillion yuan, up 10.9%; the asset-liability ratio was 58.58%, down 0.18 percentage points from the same period last year. From January to November, accounts receivable amounted to 103.78 billion yuan, an increase of 3.3%, while funds for finished products amounted to 10.67 billion yuan, an increase of 34.4%. In addition, the financial and management costs of the refining industry increased by 6.6% and 4.6% respectively in the first November.

From January to November, the profit margin of refinery owner's business income was 5.06%, which was 0.94 points lower than that of the previous year, while the gross profit margin was 20.14%, which was 3.05 points lower. Inventory turnover of finished products is 11.1 days, and the average payback period of accounts receivable is 9.4 days.

(3) The slowing trend of economic benefits in chemical industry

Profit growth slowed down. From January to November 2018, 24842 Enterprises above the scale of the chemical industry achieved a total profit of 479.11 billion yuan, an increase of 19% over the previous year. The growth rate fell by 2.7 percentage points from January to October, accounting for 56.3% of the total profits of the petroleum and chemical industries. Among them, the profits of coal chemical products, fertilizers, basic chemical raw materials and pesticides increased rapidly, reaching 334.7%, 48.8%, 32.7% and 26.6% respectively. In addition, profits of synthetic materials, specialty chemicals and paint manufacturing increased by 10.8%, 7.9% and 12.9% respectively, while profits of rubber products and chemical mineral processing increased by 5.5% and 18%, respectively.

Unit cost has decreased and the situation of loss-making enterprises has continued to improve. From January to November, the main business cost of the chemical industry was 5.87 trillion yuan, an increase of 9% compared with the same period last year, and the cost of the main business income per 100 yuan was 84.61 yuan, a decrease of 0.54 yuan compared with the same period last year. Among them, the main income cost of basic chemical raw material manufacturing is 83.91 yuan per 100 yuan, synthetic material manufacturing is 86.71 yuan, special chemicals manufacturing is 84.87 yuan, paint manufacturing is 79.97 yuan, fertilizer manufacturing is 85.89 yuan, rubber products is 85.58 yuan, coal chemical products manufacturing is 81.21 yuan. In the first November, the loss area of the chemical industry was 16.5%, which was 0.3 percentage points smaller than that in January-October; the loss of loss enterprises was 53.29 billion yuan, down 14.5%; the total assets was 8.06 trillion yuan, up 5.5%; and the asset-liability ratio was 56.03%, down 1.12 percentage points from the same period last year. From January to November, the receivables of chemical industry amounted to 837.21 billion yuan, an increase of 9.1% over the same period of last year, while the funds for finished products amounted to 339.48 billion yuan, an increase of 14%. In addition, financial and management costs increased by 4.3% and 11.4%, respectively.

From January to November, the profit margin of the main business income of the chemical industry was 6.9%, up 0.54 points from the same period last year, and the gross profit margin was 15.39%, up 0.54 points. The turnover days of finished products are 18.5 days, and the average payback period of accounts receivable is 37.2 days.

From the profit growth structure of chemical industry, the contribution rate of basic chemical raw materials and synthetic materials is still high, reaching 50.8% and 11.9% respectively, and that of special chemicals is 10.2%. It is noteworthy that the contribution rate of fertilizer manufacturing profit growth has risen sharply to 10.7%.

III. Major Market Trends

In November 2018, the overall price rise of the petroleum and chemical industries was markedly frustrated. Among them, the ex-factory price of oil and natural gas extraction industry rose 24.4% year on year, which dropped 18.4 percentage points compared with last month; chemical raw materials and chemical manufacturing industry rose 3.9% and fell 2.2 percentage points. In November, the ex-factory price of oil and natural gas production fell by 7.5% and that of chemical raw materials and chemicals production by 0.7%. From January to November, the total price of oil and gas production rose by 26.3%, while chemical raw materials and chemical manufacturing rose by 6.8%.

(1) International oil prices have fallen sharply

In November 2018, international oil prices were blocked, fluctuated sharply and the average price fell sharply. Monitoring data show that the average price of WTI crude oil (Pu's spot) fell by 15.2% from the previous month, up 12.1% from the previous year; the average price of Brent crude oil fell by 15.2% from the previous month; the average price of Dubai crude oil fell by 12.6% from the previous year, up by 18.5% from the previous year; and the average price of Shengli crude oil fell by 13.4% from the previous year. The average price of crude oil in the four places in November was $66.41 per barrel, down 14.1% from the previous month and up 14.8% from the previous year.

Futures prices fell and stabilized. By the end of November, the average price of light crude oil delivered on the New York Mercantile Exchange in December was $55.88 per barrel, down 1.2% from a year earlier; the average price in January 2019 was $56.06 per barrel, down 3.2% from a year earlier; the average price of crude oil delivered in London in December was $65.26 per barrel, up 4.2% from a year earlier; and the average price in January 2019 was $65.49 per barrel, up 2.1%. The average crude oil price for December delivery on the Shanghai Stock Exchange was 460.17 yuan per barrel, down 19.1% from the previous month.In January 2019, it was 467.51 yuan per barrel, up 1.6% from the previous year.

(2) The operation of the fertilizer market is basically stable

In November 2018, the domestic fertilizer market generally ran smoothly and maintained an upward trend. Prices of major varieties fluctuated slightly. Monitoring showed that the average price of urea market in that month was 2100 yuan (ton price, the same below), the ring-to-ring ratio was down 0.9%, up 20% year on year; the average price of diammonium phosphate was 2730 yuan/ton, up 0.7%, up 1.1% year on year; the average price of monoammonium phosphate was 2270 yuan, up 0.9%, down 3.8% year on year; the average price of domestic potassium chloride was 2400 yuan, up 0.4% year on year, up 22.4% year on year; the average price of sulfur-based compound fertilizer was up 24.30 yuan. Ring up 1.7% year-on-year and 8% year-on-year.

(3) Disruption and differentiation of basic chemical raw materials market

In November 2018, the basic chemical raw material market showed a trend of shock differentiation and price reversal. Among them, the inorganic chemical raw material market remained relatively stable, while the oscillation of organic raw materials intensified, and the price ring ratio dropped significantly. In the same month, among the 39 main inorganic chemical raw materials monitored, the market average price increased by 16 kinds, 3 kinds less than last month, and 22 kinds more than last month, 4 kinds less than last month. Among the 84 main organic chemical raw materials monitored, 44 increased year-on-year, 12 decreased compared with the previous month; 21 increased year-on-year, 38 decreased.

Inorganic chemical raw materials: In November, the average price of sulphuric acid (98%, purified water) market was 510 yuan, up 18.6%, up 30.8% year on year; the average price of nitric acid (ge; 98%) market was 1750 yuan, up 4.2%, down 4.4% year on year; the average price of caustic soda (tablet alkali, & ge; 96%) market was 4250 yuan, down 4.5%, down 6.6% year on year; the average price of soda (heavy ash) was 1910 yuan, up 1.6% year on year, down 24.8%. The average price of calcium carbide was 2840 yuan, down 9% annually and 7.5% year-on-year, while the average price of sulphur and yellow was 1380 yuan, down 1.4% annually and up 3% year-on-year.

Organic chemical raw materials: In November, the average market price of ethylene (Northeast Asia) was US$975.8, a 17.7% drop from the previous year and a 23.3% drop from the previous year. The average price of propylene in the domestic market is 8630 yuan, down 14.6%, up 7.5% year on year; the average price of pure benzene is 6310 yuan, down 9.9%, down 4.7% year on year; the average price of toluene (oil grade, water purification) is 5930 yuan, down 14.3% year on year, up 6% year on year; the average price of methanol is 3100 yuan, down 4.6% year on year, up 0.6% year on year; the average price of ethylene glycol is 6490 yuan, down 9.1% year on year. 12.1%.

(4) Market Recurrence of Synthetic Materials

In November 2018, the overall shocks in the synthetic materials market intensified, and prices pulled back across the board. Generally speaking, the range of callback of synthetic fiber raw materials is small.

Composite resin: In November, the average price of polyvinyl chloride (LS-100) market was 6720 yuan, 4.3% lower and 4.2% higher than that of the previous year; the average price of high density polyethylene (5000S) was 10550 yuan, 7.5% lower and 1.4% higher than that of the previous year; the average price of polypropylene (T30S) was 10820 yuan, 2.5% lower and 16.8% higher than that of the previous year; the average price of PA66 (101L) was 36700 yuan, 2.1% lower and 46.2% higher than that of the previous year; The average price of polyester chips (filament semi-gloss) was 8,260 yuan, which was 15.6% lower than that of the previous year and 6.3% higher than that of the previous year.

Rubber: In November, the average price of cis-butadiene rubber (grade I) market was 12,400 yuan, down 6.8%, up 2.5% year-on-year; the average price of styrene-butadiene rubber (1502) was 12,300 yuan, up 0.8%, down 1.4% year-on-year; the average price of nitrile rubber (26A) was 21,400 yuan, down 8.9%, up 15.4% year-on-year; and the average price of chloroprene rubber (A-90) was 28,600 yuan, down 3.4% year-on-year, up 51.3%.

Synthetic Fiber Raw Materials: In November, the average market price of caprolactam (≥ 99.9%) was 16900 yuan, which was 1.6% lower than the previous year and increased by 6.3%; the average price of acrylonitrile (≥ 99.9%) was 15900 yuan, which was 1.2% lower than the previous year, 29.3% higher than the previous year; and the average price of purified terephthalic acid was 6810 yuan, which was 11.6% lower than the previous year and 22.5% higher than the previous year.

(5) Tire market stabilization

In November 2018, the domestic tire market showed signs of stabilization. Prices of major products were running at a low level with little fluctuation. Market monitoring showed that the monthly average market price of truck meridian tire (12.00R20-18PR) was 2132 yuan per piece, the ring ratio was flat, down 1.2%; the average price of car meridian tire (215/55R16) was 573 yuan per piece, the ring ratio was flat, down 2.1%; the average price of light truck bias tire (7.50-16-14PR) was 645 yuan per piece, the ring ratio was flat, down 1.5%.

IV. NEW SITUATION, NEW PROBLEMS AND PREDICTION OF MAIN ECONOMIC INDEXES

(1) New situations and problems in the current economic operation

First, Global trade restriction policies continue to increase. On December 11, 2018, the World Trade Organization issued its annual report, pointing out that from mid-October 2017 to mid-October 2018, WTO members implemented 137 new trade restrictions, with an average monthly increase of about 11. At the same time, the total trade covered by the trade restriction measures implemented by members reached 588.3 billion US dollars, more than seven times larger than the previous year. In addition, at a seminar held in Geneva, WTO Director-General Azevido said that the international trade environment was facing systemic challenges. Replacing the coordinated tariff policies formulated by countries with unilateral tariff policies would significantly reduce global trade volume and lead to a sharp decline in global economic growth. At present, international authorities generally believe that the world economy in 2019 is affected by unilateralism and trade frictions, and growth is facing tremendous challenges.With downward pressure, growth will slow down.

Second, the petrochemical market shook sharply and prices fell. In November 2018, the prices of some major petroleum and chemical commodities fell sharply. Monitoring data show that the average monthly spot prices of WTI crude oil and Brent crude oil fell by 15.2% annually, while the average price of crude oil futures delivered on the Shanghai Stock Exchange in December fell by 19.1% annually by the end of November. Monitoring also showed that some bulk organic chemical raw materials and synthetic materials fell considerably in the same month, such as propylene, toluene and PTA prices fell by 14.6%, 14.3% and 22.5% respectively in February. Prices of bulk products have fallen sharply, seriously damaging market confidence and expectations.

Third, the growth of demand is weak. From January to November 2018, the apparent consumption of diesel oil in China decreased by 3.3% and increased by 0.1 percentage points compared with the previous October, indicating that macroeconomic activity continued to slow down. From the perspective of chemical industry market, the growth rate of production of major chemicals is only 2.5%, which is slower than that in October, indicating that the overall growth of market demand for chemicals is weak.

Fourthly, the motive force of investment is still insufficient. From January to November 2018, although investment in chemical raw materials and chemicals manufacturing industry continued to accelerate, the growth rate was only 5.8%, which was still below the average growth rate of 6.4% of the national industrial investment. The momentum of the industry investment rebound was still obviously insufficient.

(2) Prediction of major economic indicators

According to the analysis of macroeconomic trend, industry production, price trend and structural adjustment, it is estimated that the main business income of petroleum and chemical industry will be about 12.65 trillion yuan in 2018, an increase of about 13% year on year. Among them, the business income of chemical industry owners is about 7.55 trillion yuan, an increase of 9%.

It is estimated that the total profit of the petroleum and chemical industries will exceed 900 billion yuan in 2018, a record high of about 30% growth. Among them, the total profit of the chemical industry is about 500 billion yuan, an increase of 15%.

The total export volume of petroleum and chemical industries is estimated to be about $212 billion in the whole year, an increase of 10% over the previous year.

It is estimated that the apparent consumption of crude oil will be 633 million tons in the whole year, an increase of 4.5% over the same period of last year; the apparent consumption of natural gas will be 281 billion cubic meters, an increase of 17.5%; the apparent consumption of refined oil will be 327 million tons, an increase of 2%; the apparent consumption of fertilizer will be about 47.8 million tons (converted to pure), a decrease of 4%; the apparent consumption of synthetic resin will be about 112 million tons, an increase of 4.5%; the apparent consumption of ethylene will be about 20.85 million tons, an increase of 3%; Apparent consumption was about 32.15 million tons, an increase of 2.5%.

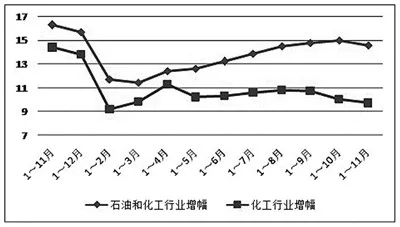

Cumulative growth trend of added value of petroleum and chemical industry (unit:%) from November 2017 to November 2018

Accumulative Income Growth Trend of Petroleum and Chemical Owners from November 2017 to November 2018 (Unit:%)

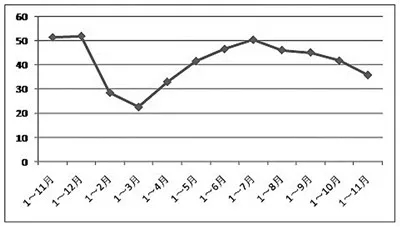

Accumulative growth of total profits in petroleum and chemical industries from November 2017 to November 2018 (unit:%)

(Source: China Petroleum and Chemical Industry Federation)